Discover essential strategies for E-commerce fraud prevention to safeguard your business and protect your customers from online fraudsters.

Types of E-commerce Fraud

When it comes to e-commerce fraud, there are several tactics and techniques that fraudsters use to deceive businesses and customers. Understanding the different types of e-commerce fraud is crucial for implementing effective prevention measures to protect your online business and customers.

1. Identity Theft: This type of fraud involves criminals stealing personal information such as credit card details, social security numbers, or login credentials to make unauthorized purchases.

2. Phishing: Fraudsters use fake emails, websites, or messages to deceive customers into providing sensitive information, which can then be used for fraudulent activities.

3. Chargeback Fraud: In this scam, a customer makes a purchase online, receives the goods or services, and then files a false claim with their credit card company to get a refund while keeping the product.

4. Account Takeover: Hackers gain access to a customer’s account by stealing login credentials and make unauthorized purchases using the victim’s saved payment methods.

5. Card Testing: Fraudsters use stolen credit card information to make small transactions to test if the card is valid before making larger unauthorized purchases.

6. Friendly Fraud: This occurs when a customer falsely claims that they did not receive the product or service they purchased, leading to chargebacks and losses for the merchant.

By being aware of the various types of e-commerce fraud, businesses can implement robust security measures, conduct regular monitoring, and educate customers to minimize the risk of falling victim to fraudulent activities.

Implementing Security Measures for Fraud Prevention

In today’s digital age, protecting your e-commerce business and customers from fraud is of utmost importance. Implementing robust security measures is crucial to ensure the safety of transactions and data. Here are some key strategies to consider:

1. Secure Payment Gateways

Utilize secure payment gateways that encrypt sensitive payment information to prevent unauthorized access. Partner with reputable payment processors that offer advanced fraud detection tools.

2. Two-Factor Authentication

Require two-factor authentication for customer logins and transactions. This extra layer of security reduces the risk of unauthorized access even if login credentials are compromised.

3. Regular Security Audits

Conduct regular security audits to identify vulnerabilities in your e-commerce platform. Fix any weaknesses promptly to prevent potential breaches that could lead to fraud.

4. Fraud Monitoring Tools

Invest in fraud monitoring tools that use advanced algorithms to detect suspicious activities and patterns. Real-time monitoring can help you identify and respond to potential threats promptly.

5. Educate Your Team and Customers

Provide training sessions for your team on fraud prevention best practices. Educate your customers on how to recognize phishing attempts and protect their personal information.

6. Data Encryption

Implement data encryption protocols to safeguard sensitive customer data, such as credit card details and personal information. Encryption ensures that data is unreadable to unauthorized parties.

The Role of Machine Learning in Fraud Detection

Within the realm of e-commerce fraud prevention, one of the key players in safeguarding businesses and customers alike is machine learning technology. Machine learning algorithms have transformed the landscape of fraud detection by enabling automated systems to detect and prevent fraudulent activities in real-time. Here’s how machine learning plays a pivotal role in enhancing fraud detection:

Data Analysis and Pattern Recognition: Machine learning algorithms excel at analyzing vast amounts of transactional data to identify patterns and anomalies that might indicate fraudulent behavior. By continuously learning from new data, these algorithms can adapt and improve their detection capabilities over time.

Real-Time Monitoring and Decision Making: Machine learning systems are capable of monitoring transactions and activities in real-time, enabling them to swiftly flag any suspicious behavior or transactions for further review. This instant responsiveness is crucial in preventing fraud before it causes significant harm.

Customized Risk Scoring: Machine learning models can assign risk scores to transactions based on various factors such as past behavior, transaction amount, device used, and more. By customizing risk assessments for each transaction, businesses can prioritize high-risk activities for immediate attention.

Ongoing Training and Adaptation: Machine learning algorithms are designed to continuously learn and adapt to new fraud patterns and techniques, ensuring that they stay ahead of evolving threats. This adaptability is essential in the ever-changing landscape of fraud in e-commerce.

Improved Accuracy and Efficiency: By leveraging the power of machine learning, businesses can achieve higher levels of accuracy in fraud detection while reducing false positives. This not only strengthens security measures but also enhances the overall efficiency of fraud prevention efforts.

Educating Customers About Secure Online Shopping

As an e-commerce business owner, safeguarding your customers against online shopping fraud is essential for building trust and loyalty. One crucial aspect of fraud prevention is educating your customers about how to shop securely online.

1. Encourage Strong Password Usage: Emphasize the importance of creating unique and complex passwords for their accounts to prevent unauthorized access.

2. Verify the Website’s Security: Teach customers to look for secure connections (https://) and trustmarks such as SSL certificates when making online purchases.

3. Be Cautious with Personal Information: Advise customers to be wary of sharing sensitive details like credit card numbers or passwords via email or unknown websites.

4. Utilize Two-Factor Authentication: Encourage customers to enable two-step verification for an added layer of security when logging in to their accounts.

5. Stay Informed About Common Scams: Provide regular updates on prevalent online shopping scams and how customers can identify and avoid falling victim to them.

Collaborating with Payment Providers for Enhanced Security

When it comes to safeguarding your e-commerce business against fraud, partnering with payment providers can significantly enhance security measures. These strategic collaborations offer a multi-layered approach that combines expertise, technology, and real-time monitoring to protect both your business and customers.

Payment providers utilize advanced fraud detection tools and algorithms to analyze transactions and identify suspicious activities. By integrating these tools into your payment processing system, you can mitigate risks and prevent fraudulent transactions before they occur.

Additionally, working closely with reputable payment providers allows for continuous monitoring of transaction patterns and behaviors. Any anomalies or irregularities can be promptly flagged and investigated, ensuring that fraudulent activities are swiftly addressed.

Furthermore, collaborating with payment providers enables access to the latest security protocols and industry best practices. This ensures that your e-commerce platform is equipped with cutting-edge security measures to stay ahead of evolving fraud tactics.

By forging strong partnerships with payment providers, you demonstrate your commitment to protecting your business and fostering trust with your customers. Leveraging their expertise and resources will help bolster your fraud prevention strategies and create a secure environment for online transactions.

Case Studies: E-commerce Platforms Combatting Fraud

In the ever-evolving landscape of e-commerce, fraud prevention has become a critical aspect for businesses to safeguard their operations and protect their customers. Various e-commerce platforms have implemented innovative strategies to combat fraud effectively.

Case Study 1: AI-Powered Detection Systems

One prominent case study involves an e-commerce platform that utilizes artificial intelligence (AI) technology to analyze customer behavior and detect any suspicious activities. By leveraging AI-powered algorithms, the platform can flag potentially fraudulent transactions in real-time, minimizing the risk of financial loss.

Case Study 2: Multi-Factor Authentication

Another successful example is an e-commerce platform that integrates multi-factor authentication measures during the checkout process. By requiring customers to verify their identity through multiple steps, such as OTP codes or biometric scans, fraudulent attempts are thwarted, ensuring a secure shopping experience for all users.

Case Study 3: Collaborative Data Sharing

Collaboration among e-commerce platforms to share data on potential fraudsters has also proven to be effective. By exchanging information on suspicious accounts or transactions, these platforms can collectively strengthen their fraud detection abilities and enhance overall cybersecurity defenses.

These case studies highlight the proactive approach taken by e-commerce platforms in combatting fraud. By leveraging advanced technologies, implementing robust security measures, and fostering industry collaboration, businesses can effectively protect themselves and their customers from fraud risks in the digital marketplace.

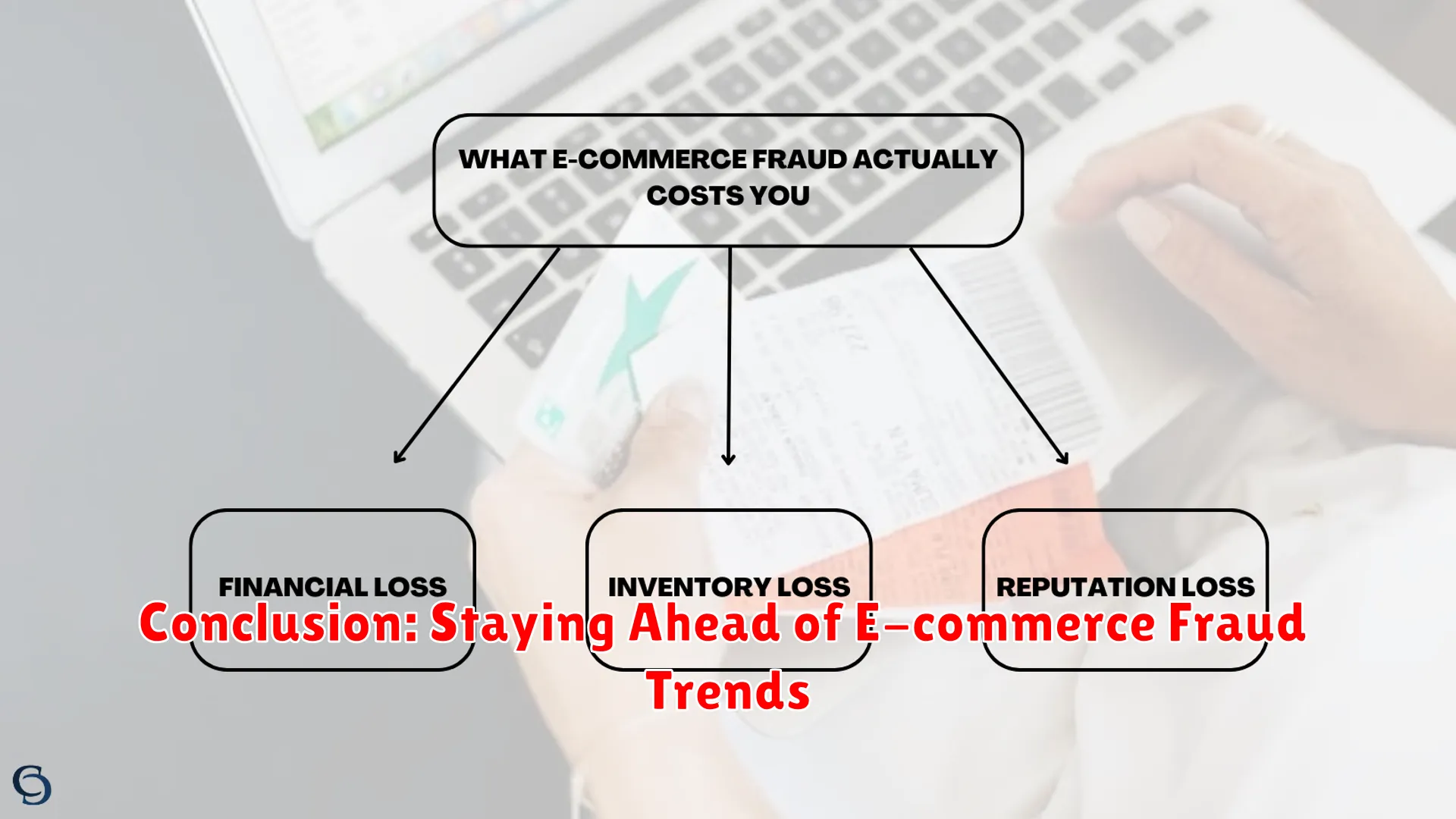

Conclusion: Staying Ahead of E-commerce Fraud Trends

As the e-commerce landscape continues to evolve, the threat of fraud also adapts and poses challenges to businesses and consumers alike. Staying ahead of e-commerce fraud trends is crucial to protecting your business and customers. By being proactive and vigilant, you can implement effective fraud prevention strategies to safeguard your online transactions.

One key aspect of staying ahead of e-commerce fraud trends is to regularly update your security measures. This includes utilizing the latest anti-fraud tools and technologies to detect and prevent fraudulent activities. Additionally, educating your staff and customers on common fraud schemes and best practices can help create a culture of awareness and accountability.

Furthermore, monitoring and analyzing transaction data can provide valuable insights into potential fraudulent activities. By leveraging data analytics and artificial intelligence, you can identify patterns or anomalies that may indicate fraudulent behavior, allowing you to take immediate action to mitigate risks.

Collaboration with industry partners and sharing information about emerging fraud trends can also play a significant role in staying ahead of the curve. By participating in industry forums, sharing best practices, and staying informed about the latest fraud tactics, you can strengthen your defenses and protect your business from evolving threats.

In conclusion, keeping up-to-date with e-commerce fraud trends and proactively implementing fraud prevention measures are essential for safeguarding your business and maintaining trust with your customers. By staying vigilant and adapting to the changing landscape of online fraud, you can minimize risks and protect your reputation in the digital marketplace.

Conclusion

Implementing robust fraud prevention measures is crucial to safeguarding both your business and customers in the ever-evolving landscape of e-commerce.