In the digital age, teaching children financial literacy is more crucial than ever. This article explores the importance of instilling money management skills in kids to help them navigate the complexities of personal finance in the future.

Importance of Financial Education for Children

Teaching kids about financial literacy and money management skills is crucial in today’s world. By instilling these values at a young age, children can develop a strong foundation for their future financial well-being.

One of the key reasons for the importance of financial education for children is to help them understand the value of money and the concept of saving. By learning how to manage money wisely, kids can avoid falling into the trap of overspending and accumulating debt later in life.

Moreover, financial education can teach children about the importance of setting goals and making informed decisions when it comes to money. These skills are essential for building a secure financial future and being able to handle financial responsibilities as they grow older.

Furthermore, teaching kids about financial literacy can also help them develop a sense of responsibility and independence. By understanding the basics of budgeting, saving, and investing, children can become more confident in managing their finances and planning for the future.

In conclusion, financial education for children is crucial in preparing them for the challenges of adulthood and empowering them to make sound financial decisions throughout their lives.

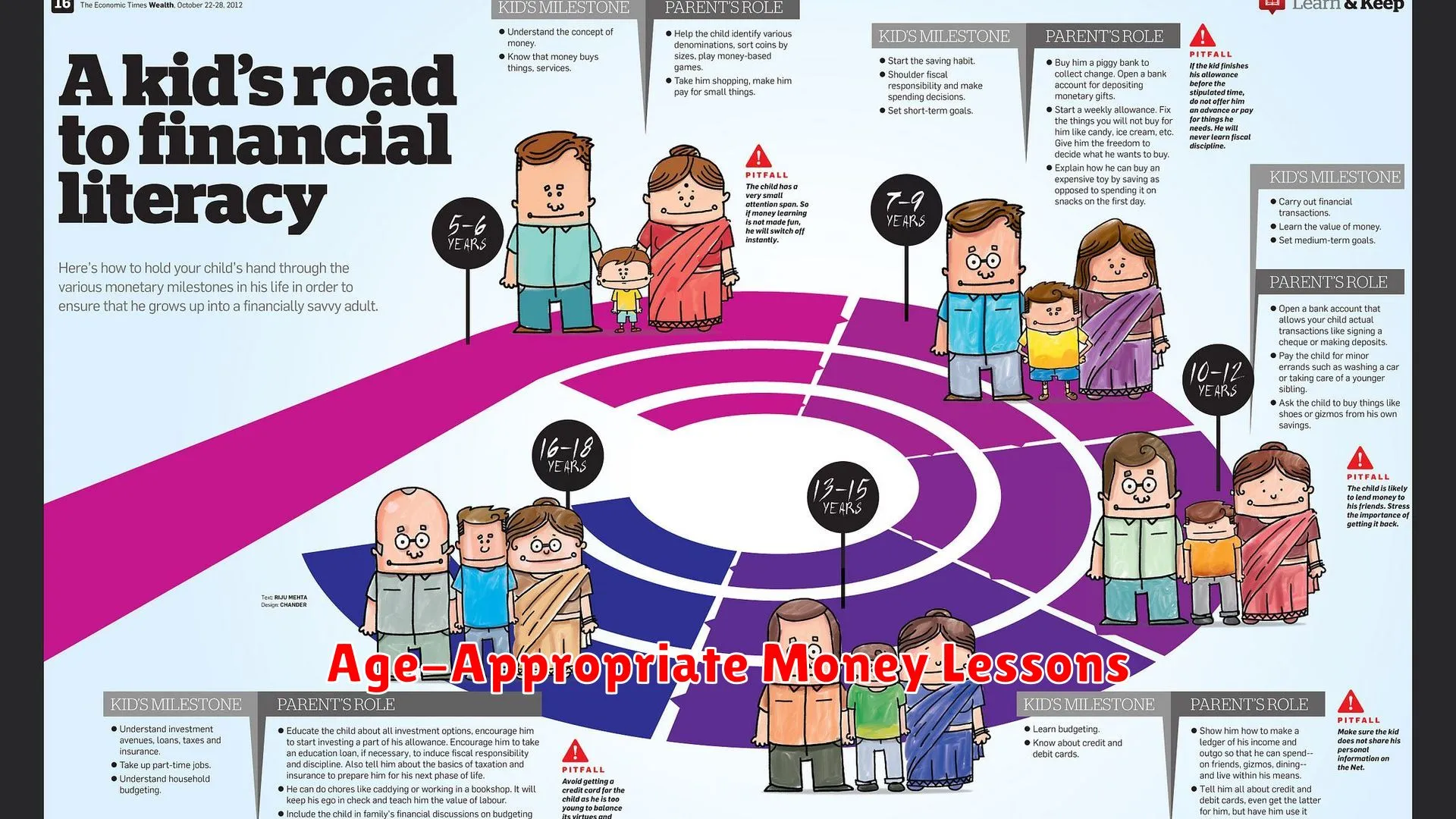

Age-Appropriate Money Lessons

When it comes to teaching financial literacy to kids, understanding age-appropriate money lessons is crucial. Tailoring the lessons based on a child’s developmental stage can make a significant impact on their understanding of money management skills. Here are some key age-specific money lessons to consider:

Preschoolers (Ages 3-5)

For preschoolers, the focus should be on introducing basic concepts like identifying coins and understanding their values. Simple activities such as sorting coins, playing store, and using a piggy bank can help them grasp the idea of money and its uses.

Elementary School Kids (Ages 6-10)

As kids enter elementary school, it’s essential to teach them the importance of saving and setting goals. Encourage them to save a portion of their allowance or earnings towards a specific item they want. Introducing the concept of budgeting and distinguishing between needs and wants can also be beneficial at this stage.

Preteens and Teens (Ages 11-18)

Older kids can delve deeper into more complex money topics such as budgeting for larger expenses, understanding interest rates, and the impact of borrowing money. Introducing them to basic banking concepts like opening a savings account and monitoring transactions online can help prepare them for financial independence.

Encouraging Saving and Budgeting

Teaching kids about financial literacy includes instilling the importance of saving and budgeting from a young age. Here are some effective ways to encourage these habits:

1. Set Savings Goals

Help children learn the value of saving by setting realistic savings goals. Whether it’s saving for a toy, a game, or a future trip, having specific targets to work towards can motivate them to save.

2. Use Piggy Banks or Savings Jars

Give kids their own piggy banks or savings jars to physically deposit money. This tactile experience can make the concept of saving money more concrete for them.

3. Create a Budget Together

Show children how to manage money by creating a simple budget. Discuss the difference between needs and wants, allocate money for different categories, and track their spending.

4. Offer Rewards for Saving

Consider offering small rewards or incentives as a way to motivate saving. Celebrating their effort can reinforce positive saving behaviors.

5. Lead by Example

Remember that kids often learn by observing. Demonstrate responsible financial habits in your own behavior, such as saving regularly and sticking to a budget.

Introducing Investing Concepts

When teaching kids about financial literacy, introducing investing concepts can be a valuable aspect of their money management education. By helping children understand the basics of investing, you are setting them on a path towards financial independence and a secure future.

One fundamental concept to introduce is the idea of compound interest. Explain to kids that when they invest money, it has the potential to grow over time due to the power of compounding. This concept teaches them the benefits of starting to invest early and letting their money work for them.

Another key concept is diversification. Encourage children to spread their investments across different asset classes to reduce risk. By diversifying their portfolio, they can protect themselves from potential losses in any single investment.

Teaching kids about risk and return is also essential. Help them understand that while higher returns are attractive, they often come with higher risk. Encourage them to assess their risk tolerance and make informed investment decisions.

Lastly, introduce the concept of long-term investing. Emphasize the importance of patience and discipline in investing. Teach children that investing is a marathon, not a sprint, and that long-term strategies typically yield better results.

Tools and Resources for Teaching Financial Literacy

When it comes to educating kids about money management and financial literacy, utilizing the right tools and resources can make a significant impact. Here are some helpful resources and methods that can be effective in teaching kids about financial literacy:

1. Interactive Websites:

Interactive websites geared towards financial education for children can offer engaging ways to learn about money management. Websites like PracticalMoneySkills and Moneyasyougrow provide interactive games and tools that make learning about finances fun and interactive.

2. Financial Literacy Apps:

There are numerous financial literacy apps available that cater to children of different age groups. Apps like PiggyBot and Bankaroo help kids understand concepts like budgeting, saving, and setting financial goals through interactive features.

3. Books and Workbooks:

Books and workbooks specifically designed for teaching financial literacy to kids can be an invaluable resource. Titles like “The MoneySmart Family System” by Steve and Annette Economides or “The Everything Kids’ Money Book” by Brette McWhorter Sember are excellent choices to introduce financial concepts to children.

4. Financial Literacy Curriculum:

Implementing a structured financial literacy curriculum in schools or homeschooling environments can provide a comprehensive approach to teaching money management skills. Programs such as the NEFE High School Financial Planning Program offer lesson plans, materials, and resources for educators.

5. Role-Playing Activities:

Engaging kids in role-playing activities related to money can help them understand real-life financial scenarios. Activities like setting up a mini-store at home, creating a budget for a family outing, or playing “grocery shopping” can teach practical financial skills in a hands-on way.

Conclusion

Instilling financial literacy in children is crucial for developing strong money management skills early on, setting them up for a successful financial future.