Planning for retirement is crucial to ensure a comfortable future. In this article, we will explore the importance of financial planning in securing your golden years.

The Importance of Retirement Planning

Retirement planning is a crucial aspect of financial management that cannot be underestimated. As individuals progress through their careers, setting aside funds for retirement becomes increasingly essential to ensure a secure and comfortable future during their golden years.

One key reason why retirement planning is vital is the potential for increased life expectancy. With advancements in healthcare and technology, people are living longer lives. Adequate retirement planning ensures that individuals can maintain their desired lifestyle even after they retire.

Moreover, retirement planning allows individuals to be prepared for unexpected expenses and emergencies in the future. Having a financial cushion in place can provide peace of mind and reduce stress during unforeseen circumstances.

Furthermore, by starting early and diligently contributing to retirement savings, individuals can benefit from the power of compounded growth. This means that the earlier one begins saving for retirement, the more time their investments have to grow, potentially resulting in a larger nest egg for the future.

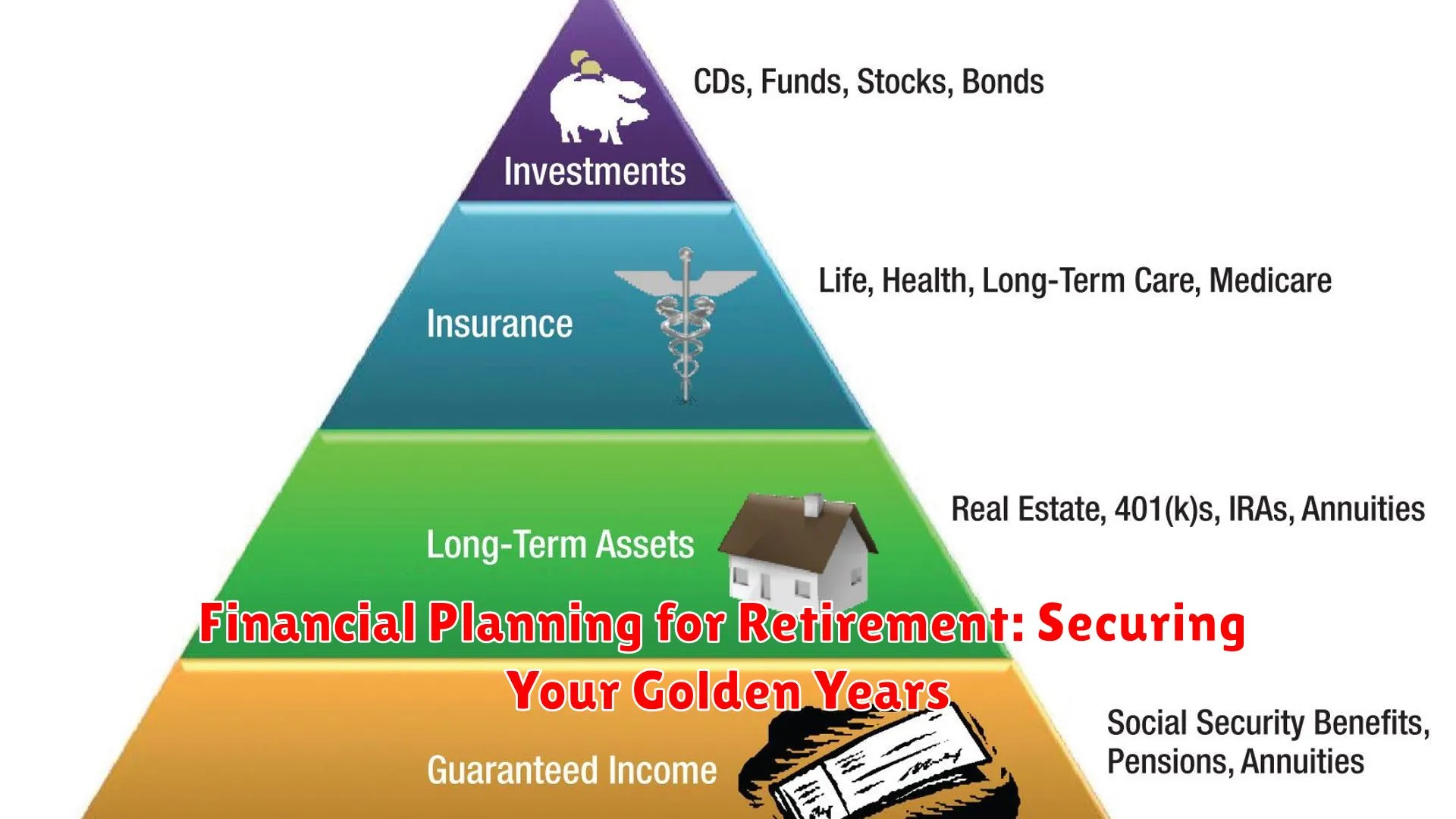

Estimating Retirement Needs

Planning for retirement involves estimating the financial resources you will need to support your lifestyle during your golden years. Consider various factors that can affect your retirement needs:

1. Current Expenses

Start by assessing your current living expenses, including housing costs, utilities, groceries, healthcare, entertainment, and any other regular expenditures. This will give you a baseline to work from when estimating your retirement budget.

2. Inflation and Cost of Living

Take into account inflation and the increasing cost of living over time. What you spend now will likely be more in the future. Incorporate inflation rates into your calculations to ensure your savings will keep up with rising costs.

3. Retirement Lifestyle

Consider the kind of lifestyle you envision for your retirement. Whether you plan to travel, pursue hobbies, dine out regularly, or downsize your living space, your retirement lifestyle choices will impact your financial needs.

4. Healthcare Costs

Healthcare expenses tend to rise as you age. Factoring in potential medical costs, insurance premiums, and long-term care expenses is crucial when estimating how much you need for retirement.

5. Social Security and Other Income Streams

Take into account any expected sources of income in retirement, such as Social Security benefits, pensions, investments, or rental income. Calculating your expected income streams can help you determine how much additional savings you’ll need.

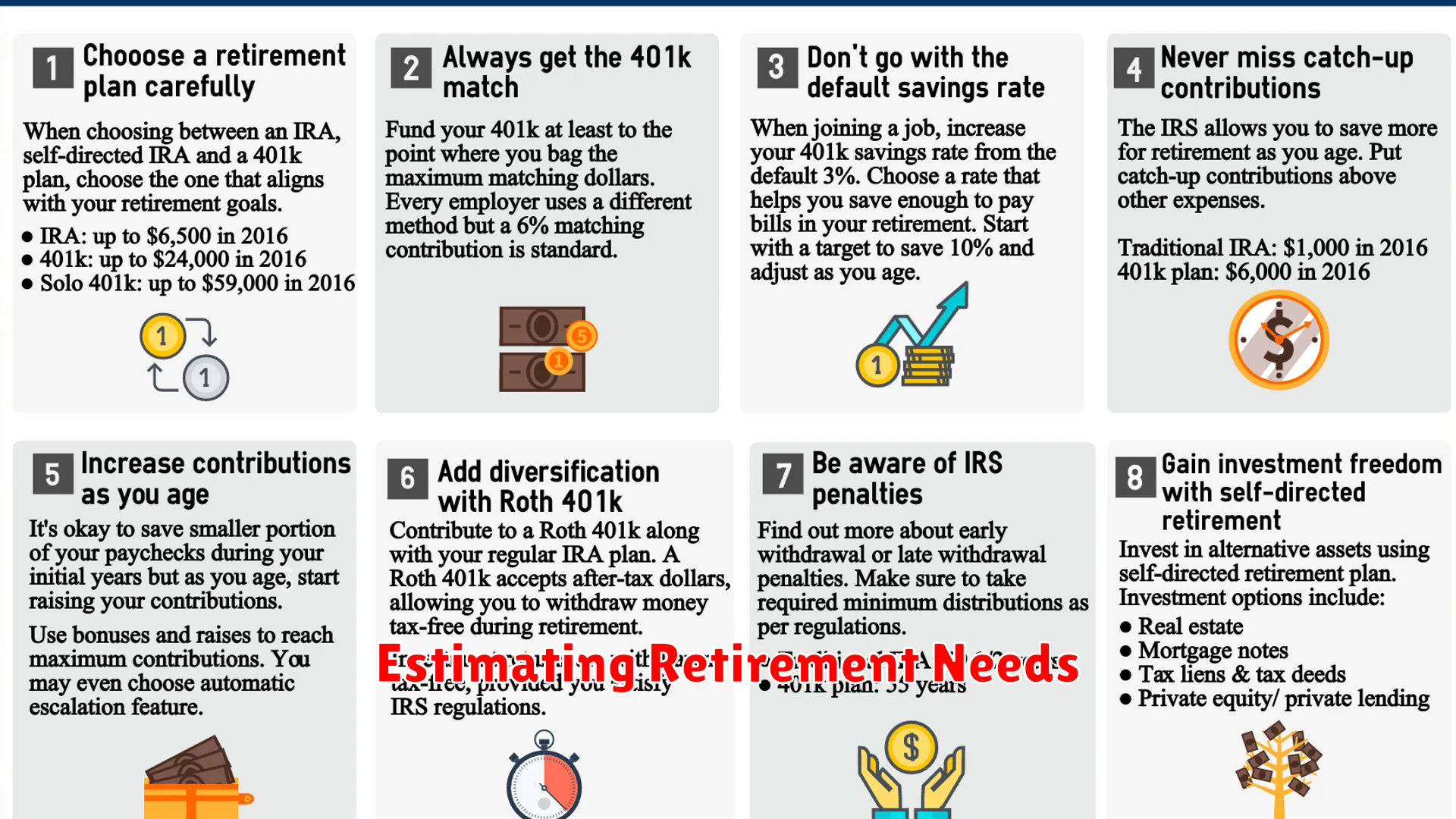

Investment Strategies for Retirement

As you plan for your retirement and aim to secure your golden years, choosing the right investment strategies is crucial. These strategies can help grow your savings and ensure a comfortable future. Here are some key investment strategies to consider:

Diversification

One of the fundamental principles of investing for retirement is diversification. By spreading your investments across different asset classes such as stocks, bonds, real estate, and commodities, you can reduce risk and increase the likelihood of consistent returns.

Asset Allocation

Asset allocation involves determining the optimal mix of assets in your investment portfolio based on your financial goals, risk tolerance, and time horizon. It is essential to periodically review and adjust your asset allocation as your circumstances change.

Long-Term Focus

Retirement investing is a marathon, not a sprint. Maintaining a long-term perspective can help you weather market volatility and take advantage of compounding returns over time. Avoid making impulsive decisions based on short-term market fluctuations.

Regular Contributions

Consistent contributions to your retirement accounts, such as 401(k) or IRA, can help accelerate your savings growth. Set up automatic contributions to take advantage of dollar-cost averaging and ensure you are steadily building your nest egg.

Professional Guidance

Seeking advice from a financial advisor can provide valuable insights and help you create a customized investment plan tailored to your retirement goals. A professional can offer expertise on market trends, risk management, and overall financial planning strategies.

Social Security and Pension Considerations

When planning for retirement and aiming to secure your golden years, it is essential to consider your Social Security benefits and pension arrangements. These can play a significant role in providing a financial safety net during your retirement years.

Social Security Benefits

Understanding how Social Security benefits work is crucial. You should be aware of when you can start claiming benefits and how your claiming age can affect the amount you receive. Consider consulting with a financial advisor to determine the optimal strategy for claiming your Social Security benefits.

Pension Plans

If you are entitled to a pension through your employer, make sure to review the details of your pension plan. Take note of factors such as vesting schedules, contribution amounts, and payout options upon retirement. Additionally, consider how your pension income will complement other sources of retirement income.

Maximizing Retirement Income

Integrating your Social Security benefits and pension income into your overall retirement plan can help maximize your retirement income. Explore strategies to optimize these sources of income and ensure they align with your long-term financial goals.

By carefully considering your Social Security and pension options, you can enhance the financial security of your retirement years and enjoy a more comfortable lifestyle during this phase of life.

Estate Planning Essentials

When it comes to financial planning for retirement, estate planning is a crucial component to secure your assets and ensure a smooth transition for your heirs. Estate planning essentials play a significant role in safeguarding your legacy and ensuring that your wishes are carried out effectively.

1. Will and Trust: Creating a will and establishing a trust are fundamental steps in estate planning. A will outlines how you want your assets distributed upon your passing, while a trust can provide additional benefits such as minimizing estate taxes and avoiding probate.

2. Power of Attorney: Designating a power of attorney is vital in estate planning, as it allows someone to make financial or healthcare decisions on your behalf if you become incapacitated. Ensuring that you have a trusted individual to act in your best interests is key.

3. Beneficiary Designations: Reviewing and updating beneficiary designations on your retirement accounts, life insurance policies, and other assets is essential. This ensures that your assets are distributed according to your wishes and bypass probate.

4. Healthcare Directives: Establishing healthcare directives, such as a living will or healthcare proxy, allows you to dictate your medical preferences in case you are unable to communicate them yourself. This ensures that your healthcare decisions align with your values.

5. Guardianship for Minor Children: If you have young children, appointing a guardian in your estate plan is crucial. This ensures that your children will be cared for by someone you trust in the event of your passing.

Conclusion

Proper financial planning is essential to ensure a secure and comfortable retirement. Start early, set clear goals, and regularly review your plan to achieve financial freedom in your golden years.