Discover how new technologies and trends are shaping the future of e-commerce payments, revolutionizing the way we buy and sell online.

The Evolution of Online Payment Methods

As e-commerce continues to flourish, the evolution of online payment methods has been a pivotal aspect of this growth. The history of online payments dates back to the early days of the internet when credit cards were the primary mode of transaction. However, advancements in technology and changing consumer preferences have led to a rapid evolution in how payments are made online.

Digital Wallets: One of the significant developments in online payments has been the rise of digital wallets. Services like PayPal, Apple Pay, and Google Pay have revolutionized the way consumers make transactions online. These digital wallets securely store payment information and streamline the checkout process, providing convenience and security to users.

Cryptocurrency: Another emerging trend in e-commerce payments is the increasing acceptance of cryptocurrency. With the rise of digital currencies like Bitcoin and Ethereum, more online retailers are offering crypto payment options to cater to tech-savvy customers seeking alternative payment methods.

Mobile Payments: The proliferation of smartphones has also fueled the growth of mobile payment solutions. Apps like Venmo and Square Cash enable users to send money to friends, split bills, and make purchases directly from their mobile devices, transforming how people handle transactions in the digital age.

Biometric Authentication: With cybersecurity becoming a top priority, biometric authentication methods such as fingerprint scanning and facial recognition have been integrated into online payment systems. These advanced security measures provide an extra layer of protection against fraud and unauthorized access.

The Rise of Mobile Wallets and Contactless Payments

As we delve into the future of e-commerce payments, one of the most significant trends that are set to shape the landscape is the rise of mobile wallets and contactless payments. These technologies offer convenience, security, and efficiency for both consumers and businesses.

Mobile Wallets:

Mobile wallets allow consumers to store their payment information digitally on their smartphones. Popular examples include Apple Pay, Google Pay, and Samsung Pay. With just a tap or scan, users can make payments swiftly and securely. The integration of biometric authentication adds an extra layer of security, reducing the risk of fraud.

Contactless Payments:

Contactless payments enable transactions to be completed without the need for physical contact with a payment terminal. This technology utilizes Near Field Communication (NFC) or Radio Frequency Identification (RFID) to facilitate seamless and speedy transactions. It is particularly appealing in today’s world, where hygiene and safety are paramount.

The adoption of mobile wallets and contactless payments is on the rise globally, driven by the convenience they offer, the speed of transactions, and the enhanced security features they provide. This shift towards digital payment methods is reshaping the way consumers interact with businesses and make purchases online.

Cryptocurrencies and Blockchain in E-commerce

In the realm of e-commerce, the integration of cryptocurrencies and blockchain technology is revolutionizing the way online transactions are conducted. Cryptocurrencies, such as Bitcoin and Ethereum, serve as digital assets that can be used for payment in online purchases, offering merchants and consumers a decentralized and secure alternative to traditional payment methods.

Blockchain technology, the underlying technology behind cryptocurrencies, plays a pivotal role in ensuring the transparency and security of e-commerce transactions. By utilizing a decentralized and encrypted ledger, blockchain minimizes the risks of fraud and enhances the trust between buyers and sellers in the online marketplace.

The adoption of cryptocurrencies and blockchain in e-commerce opens up a myriad of opportunities for businesses to expand their global reach, streamline payment processes, and reduce transaction costs. With the potential for faster cross-border transactions and lower fees, merchants can attract a broader customer base and enhance the overall shopping experience for online consumers.

Biometric Authentication for Secure Transactions

In the ever-evolving landscape of e-commerce payments, biometric authentication has emerged as a cutting-edge technology that offers enhanced security and convenience. This innovative method utilizes unique biological characteristics such as fingerprints, iris patterns, facial recognition, and voice recognition to verify the identity of users, ensuring that transactions are conducted securely.

By implementing biometric authentication in e-commerce platforms, businesses can significantly reduce the risk of fraud and unauthorized access. Unlike traditional password-based systems, biometric data is inherently more secure as it is tied to an individual’s biological traits, making it extremely difficult for cybercriminals to replicate or steal.

Furthermore, biometric authentication simplifies the user experience by eliminating the need to remember complex passwords or PINs. This not only streamlines the payment process but also enhances customer trust and satisfaction, leading to increased loyalty and repeat purchases.

As e-commerce continues to expand globally, the adoption of biometric authentication is poised to play a pivotal role in safeguarding sensitive financial information and ensuring seamless transactions. With its promise of robust security measures and user-friendly interface, biometric technology is set to revolutionize the future of online payments.

The Impact of Regulations on Payment Technologies

Regulations play a crucial role in shaping the landscape of payment technologies in the e-commerce industry. As the sector continues to evolve rapidly, regulatory bodies are enacting measures to ensure consumer protection, data security, and innovation in payment solutions.

Consumer Protection: Regulations are put in place to safeguard consumer interests by setting standards for transparent pricing, dispute resolutions, and fraud prevention. This fosters trust between buyers and sellers in online transactions, ultimately boosting e-commerce growth.

Data Security: Stringent regulations mandate the implementation of robust security measures to protect sensitive payment information. Compliance with data protection laws not only enhances customer confidence but also reduces the risk of cybercrimes and breaches.

Innovation and Compliance: Regulatory frameworks often serve as guidelines for payment technology providers to ensure adherence to industry standards. While compliance requirements may pose some challenges, they also encourage innovation in developing secure and user-friendly payment solutions.

Overall, the impact of regulations on payment technologies is both regulatory compliance and innovation-driven. By balancing consumer protection with technological advancement, regulations contribute to the sustainable growth and future development of e-commerce payments.

Global Trends in E-commerce Payments

In the evolving landscape of e-commerce payments, there are several global trends shaping the way transactions are conducted online.

1. Rise of Mobile Payments

Mobile payments have seen tremendous growth, with more consumers choosing to make purchases using their smartphones and mobile wallets. This trend is driven by convenience and the widespread adoption of mobile technology worldwide.

2. Integration of Artificial Intelligence

The integration of artificial intelligence in e-commerce payments has been prominent, with AI being used for fraud detection, personalized recommendations, and enhancing the overall customer experience.

3. Increased Emphasis on Security

Security remains a top priority in e-commerce transactions. The adoption of secure payment technologies such as tokenization and biometric authentication is on the rise to ensure secure online payments.

4. Growth of Cryptocurrency Payments

Cryptocurrency payments have gained traction in the e-commerce space, offering a decentralized and secure payment option. More businesses are now accepting cryptocurrencies as a form of payment.

5. Expansion of Buy Now, Pay Later Services

Buy now, pay later services have become popular among consumers, enabling them to make purchases and pay for them in installments. This trend provides greater flexibility and affordability for online shoppers.

6. Sustainable Payment Options

Increasing awareness of environmental issues has led to the emergence of sustainable payment options in e-commerce. Consumers are showing interest in payment methods that support eco-friendly practices.

Case Studies: Innovations in Online Payment Solutions

As the e-commerce landscape continues to evolve rapidly, one of the key areas seeing continual advancement is online payment solutions. Various innovative approaches are being developed to enhance the efficiency and security of digital transactions. Let’s delve into some compelling case studies that highlight the latest innovations in this domain.

1. Biometric Authentication:

Companies are leveraging biometric technologies such as fingerprint recognition and facial ID to offer secure and user-friendly payment experiences. For instance, a leading e-commerce retailer implemented fingerprint authentication for quick and secure checkout processes, reducing the risk of fraudulent activities.

2. Blockchain Technology:

Blockchain’s decentralized nature provides a secure and transparent platform for payment processing. A prominent online marketplace integrated blockchain technology to facilitate fast and tamper-proof transactions, ensuring trust between buyers and sellers without the need for intermediaries.

3. Progressive Web Apps (PWAs):

Several businesses have adopted PWAs to streamline payment processes and improve user engagement. By offering seamless payment experiences through PWAs, a fashion retailer witnessed a significant increase in customer retention and conversion rates, showcasing the potential of this technology in enhancing e-commerce payments.

4. Contactless Payments:

With the rise of contactless payment methods, more online retailers are incorporating NFC (Near Field Communication) technology into their platforms. A major electronics store successfully implemented contactless payment options, providing convenient and hassle-free transactions for tech-savvy consumers.

5. AI-Powered Fraud Detection:

Artificial intelligence algorithms are being utilized to detect and prevent fraudulent activities in real-time. By employing AI-powered fraud detection tools, a global payment processor effectively reduced chargebacks and enhanced overall transaction security, establishing a safer environment for online payments.

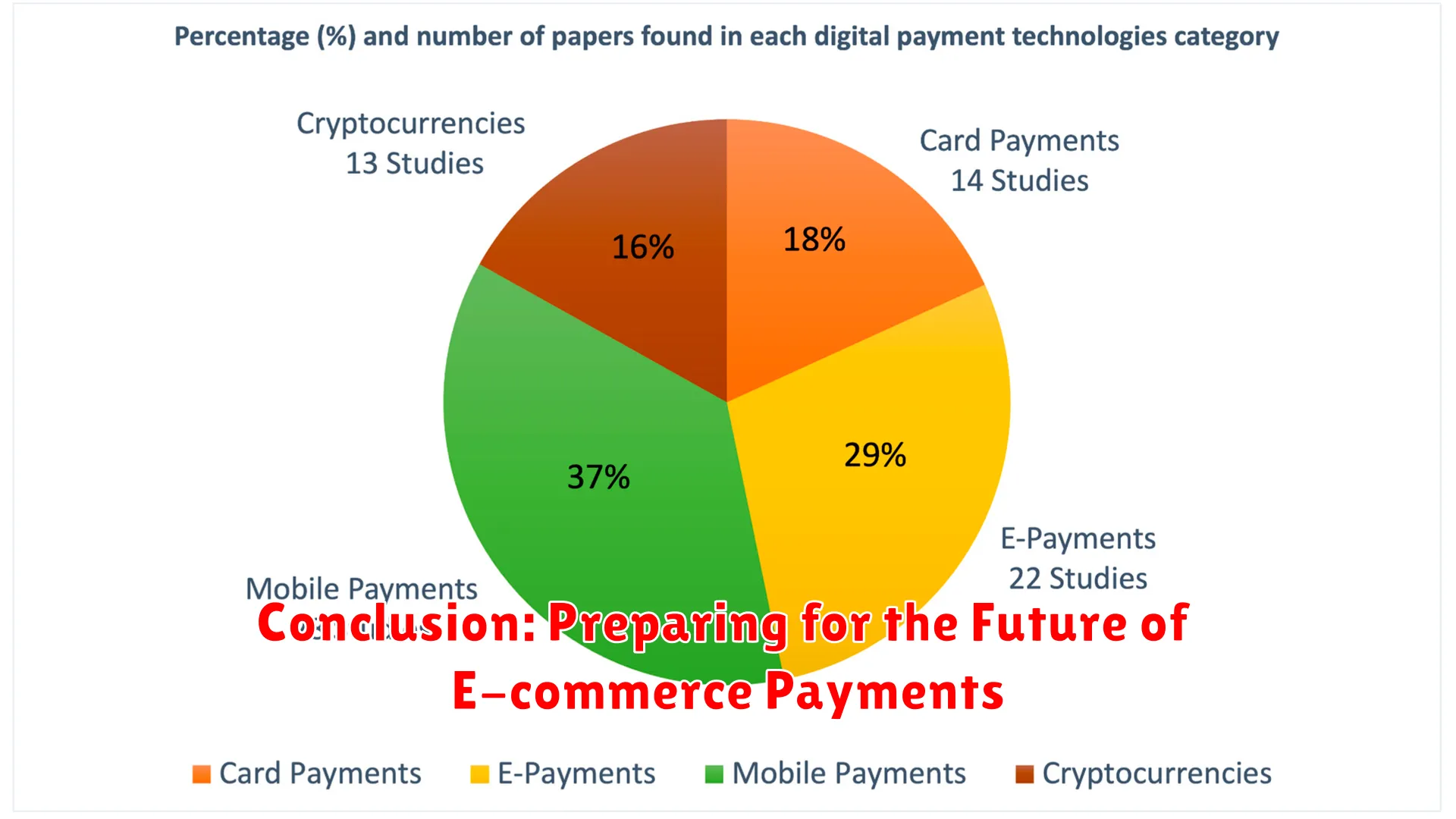

Conclusion: Preparing for the Future of E-commerce Payments

In conclusion, as the landscape of e-commerce payments continues to evolve rapidly with the integration of new technologies and the rise of innovative trends, it is crucial for businesses to stay ahead by adapting and preparing for the future.

With the increasing popularity of mobile payments and the emergence of blockchain and cryptocurrency, companies must be proactive in updating their payment systems to provide seamless and secure transactions for their customers.

Moreover, the shift towards more personalized and convenient payment experiences through technologies like AI and biometrics highlights the importance of investing in advanced payment solutions to enhance customer satisfaction and loyalty.

By staying informed about the latest developments in e-commerce payments, embracing technological advancements, and prioritizing customer-centric payment experiences, businesses can position themselves for success in the fast-changing digital economy.

Conclusion

In conclusion, the future of e-commerce payments is poised for transformation with the adoption of new technologies and the emergence of innovative trends. Businesses need to stay ahead by embracing these advancements to enhance customer experience and streamline transactions.