In the modern world, managing debt effectively is crucial for financial stability. Discover practical tips and strategies for reducing and eliminating debt wisely to achieve a healthier financial future.

The Impact of Debt on Financial Health

Debt plays a significant role in influencing an individual’s financial health. The amount of debt a person carries can have a substantial impact on their overall financial well-being. Here are some key ways in which debt can affect financial health:

1. High Interest Payments

Carrying high levels of debt often means having to make substantial interest payments. These interest payments can eat into your monthly budget, making it challenging to save money or invest for the future.

2. Credit Score Impacts

Accumulating debt can also negatively impact your credit score. A lower credit score can make it more difficult to access favorable loan terms or secure credit for important purchases.

3. Stress and Mental Health

Debt can lead to significant stress and negatively affect mental health. Constant worrying about debt repayment can impact overall well-being and lead to anxiety and other mental health issues.

4. Limited Financial Flexibility

Being heavily indebted can limit your financial flexibility. It may restrict your ability to handle unexpected expenses or take advantage of investment opportunities due to existing debt obligations.

5. Strain on Relationships

Debt can also strain personal relationships. Disagreements over financial matters, particularly debt, can lead to conflict and stress within families or between partners.

Understanding how debt can impact financial health is crucial in managing it wisely. By taking proactive steps to reduce and eliminate debt, individuals can improve their overall financial well-being and secure a more stable financial future.

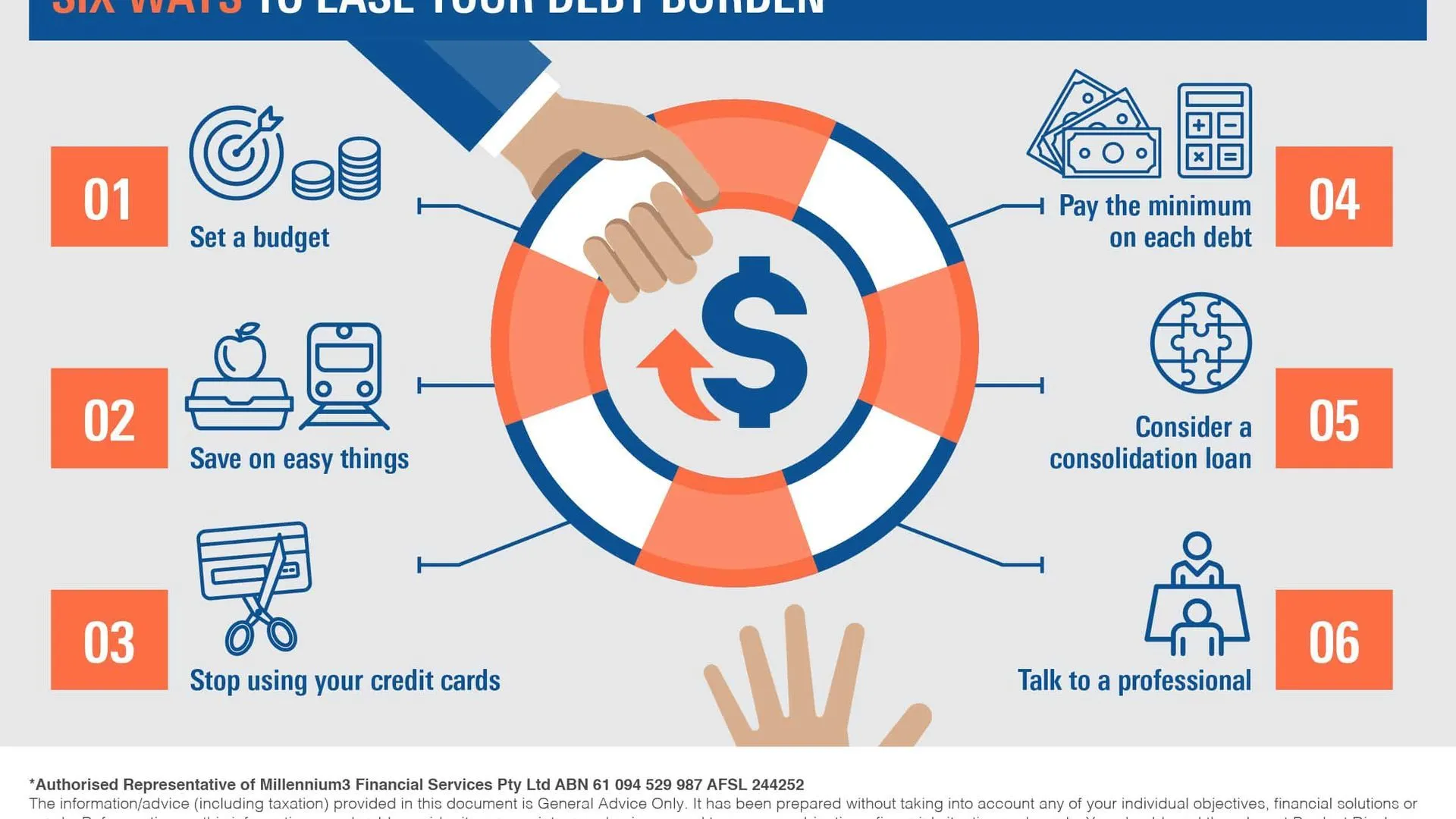

Strategies for Paying Off Debt

When it comes to managing your debt effectively, employing specific strategies can help you pay off what you owe more efficiently. Below are some key strategies for reducing and eliminating debt:

1. Create a Budget

Start by creating a detailed budget that outlines your income and expenses. Having a clear understanding of where your money is going can help you identify areas where you can cut back and allocate more funds towards debt repayment.

2. Prioritize High-Interest Debt

Focusing on paying off high-interest debt first can save you money in the long run. Make minimum payments on all your debts, but allocate extra funds towards the debt with the highest interest rate to reduce overall interest costs.

3. Snowball or Avalanche Method

Consider using either the snowball or avalanche method to pay off your debts. The snowball method involves paying off the smallest debt first, while the avalanche method targets the debt with the highest interest rate. Choose the method that best suits your financial situation.

4. Increase Income and Cut Expenses

Look for ways to increase your income, such as taking on a side job or freelance work. Cutting back on non-essential expenses can also free up more money to put towards debt repayment.

5. Seek Professional Advice

If you’re struggling to manage your debt effectively, consider seeking advice from a financial counselor or debt relief agency. They can provide personalized guidance on how to tackle your debt and improve your financial situation.

By implementing these strategies and staying committed to your debt repayment plan, you can take control of your financial future and work towards a debt-free life.

Consolidating Debt Options

When facing multiple debts, consolidating them into a single manageable payment can be a strategic move to take control of your finances. Here are some options to consider when consolidating debt:

1. Debt Consolidation Loan:

One common option is to take out a debt consolidation loan to pay off all your existing debts. By combining multiple debts into one lower-interest loan, you can simplify your payments and potentially reduce the total amount of interest you will pay.

2. Balance Transfer:

If you have high-interest credit card debt, transferring the balances to a new credit card with a lower interest rate can help you save money on interest payments. Look for credit card offers with introductory 0% APR periods for balance transfers.

3. Home Equity Loan or Line of Credit:

Homeowners may consider using the equity in their homes to consolidate debt through a home equity loan or a home equity line of credit (HELOC). Be cautious with this option as your home is used as collateral.

4. Debt Management Plan:

Working with a credit counseling agency to create a debt management plan can also help you consolidate your debts. The agency negotiates with your creditors to lower interest rates and create a structured repayment plan.

5. Personal Loans:

Another alternative is to take out a personal loan to consolidate debt. Personal loans typically have fixed interest rates and repayment terms, making it easier to budget your payments.

Before choosing a debt consolidation option, carefully evaluate the terms, interest rates, and fees associated with each method. It’s essential to create a realistic budget and avoid accumulating new debts to ensure long-term financial success.

Avoiding Common Debt Pitfalls

When it comes to managing debt wisely, it’s crucial to steer clear of common debt pitfalls that can hinder your financial well-being. Here are some vital tips to help you reduce and eliminate debt without falling into these traps:

1. Overspending and Impulse Buying

Avoid unnecessary purchases by creating a budget and sticking to it. Impulse buying can lead to accumulating debt that may be challenging to pay off.

2. Ignoring High-Interest Rates

Stay vigilant about interest rates on credit cards and loans. High-interest debt can quickly spiral out of control, making it harder to reduce your overall debt burden.

3. Making Minimum Payments Only

While making minimum payments may seem convenient, it prolongs the debt repayment process and can cost you significantly more in interest over time. Strive to pay more than the minimum whenever possible.

4. Failing to Consider Alternatives

Before taking on more debt, explore alternative options such as debt consolidation or negotiating with creditors. These solutions can help you manage debt more effectively.

5. Neglecting Savings

Having an emergency fund can prevent you from resorting to high-interest debt in times of financial strain. Prioritize saving as part of your debt management strategy.

Building a Debt-Free Future

Creating a debt-free future requires a strategic approach and discipline in managing finances. By following these tips, you can reduce and eliminate debt effectively:

1. Develop a Budget

Start by analyzing your income and expenses to understand where your money is going. Create a detailed budget that includes all your financial obligations and prioritize debt repayment in your expenses.

2. Cut Unnecessary Expenses

Identify areas where you can cut back on spending. Consider eliminating subscriptions or services that are not essential and find alternative ways to save money, such as cooking at home instead of dining out.

3. Increase Your Income

Explore additional income streams to accelerate debt repayment. This could involve taking up a part-time job, freelancing, or selling items you no longer need. Every extra dollar can make a difference in paying off debt.

4. Negotiate with Creditors

If you’re struggling to meet your debt obligations, reach out to your creditors to discuss payment plans or debt settlements. Many creditors are willing to work with you to find a solution that works for both parties.

5. Prioritize High-Interest Debt

Focusing on high-interest debt first can save you money in the long run. Target debts with the highest interest rates, such as credit card balances, and make extra payments to reduce those balances quickly.

6. Stay Committed to Your Plan

Consistency is key when it comes to managing debt wisely. Stick to your budget, continue finding ways to save and earn extra income, and celebrate small victories along the way to stay motivated.

Conclusion

In conclusion, managing debt wisely is crucial for financial stability. By following these tips, individuals can reduce and eliminate debt effectively, paving the way for a more secure future.