In the digital age, understanding your credit score is crucial. Dive into the world of credit ratings to learn how they work and discover effective strategies to enhance your financial standing.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness. It is a measure used by lenders to assess the risk of lending money to a person or granting them credit. Credit scores typically range from 300 to 850, with higher scores indicating a lower credit risk.

Factors that contribute to your credit score include payment history, amounts owed, length of credit history, types of credit used, and new credit applications. These elements are crucial in determining your overall credit score and financial health.

Understanding your credit score is essential as it influences your ability to secure loans, credit cards, mortgages, and other financial products. A good credit score can lead to better interest rates and more favorable terms, while a poor credit score may limit your financial options.

Factors Affecting Credit Scores

When it comes to understanding and improving your credit score, it’s crucial to be aware of the various factors that can influence this important number. Your credit score plays a pivotal role in your financial health, affecting your ability to secure loans, credit cards, and even favorable interest rates. Here are some key factors that can impact your credit score:

1. Payment History

One of the most significant factors influencing your credit score is your payment history. Timely payments on your credit accounts demonstrate responsible financial behavior and can positively impact your credit score. On the other hand, late payments, defaults, or delinquencies can lower your score.

2. Credit Utilization Ratio

Your credit utilization ratio refers to the amount of credit you are using compared to your total available credit. Keeping this ratio low, ideally below 30%, demonstrates responsible credit usage and can improve your credit score.

3. Length of Credit History

The length of your credit history also plays a role in determining your credit score. A longer credit history can provide a more comprehensive picture of your financial habits, potentially boosting your score.

4. Types of Credit Accounts

Having a mix of different types of credit accounts, such as credit cards, installment loans, and mortgages, can positively influence your credit score. This diversity shows that you can manage various types of credit responsibly.

5. New Credit Inquiries

Applying for multiple new credit accounts within a short period can raise red flags for creditors and negatively impact your credit score. Be mindful of the number of inquiries you make, as frequent credit applications can signal financial distress to lenders.

Strategies to Improve Your Credit

Improving your credit score is essential for financial health and future opportunities. Here are some strategies to help you boost your credit rating:

1. Pay Your Bills on Time

One of the most important factors in your credit score is your payment history. Make sure to pay all your bills on time to demonstrate responsible financial behavior. Consider setting up automatic payments or reminders to avoid missing due dates.

2. Reduce Your Debt

High levels of debt can negatively impact your credit score. Try to pay off your existing debts and avoid accumulating new ones. Keeping your credit utilization ratio low can help improve your credit rating.

3. Monitor Your Credit Report Regularly

Check your credit report at least once a year to ensure that all the information is accurate. Look out for any errors or fraudulent activities that could be affecting your credit score. Reporting and correcting mistakes promptly can prevent long-term damage to your credit.

4. Diversify Your Credit Mix

Having a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. However, make sure not to open too many accounts at once, as this could indicate financial instability to lenders.

5. Avoid Closing Credit Accounts

While it may seem counterintuitive, closing old credit accounts can actually harm your credit score. Length of credit history is an important factor, so keeping your old accounts open, even if you no longer use them regularly, can benefit your credit rating.

By implementing these strategies, you can take proactive steps to improve your credit score and pave the way for better financial opportunities in the future.

The Impact of Credit on Loans

Understanding how credit scores affect loans is crucial for anyone looking to borrow money for various purposes. Your credit score plays a significant role in determining the interest rates you receive on loans and even whether you qualify for a loan at all.

Credit Score and Interest Rates: Lenders use credit scores to assess the risk of lending money to an individual. A higher credit score typically results in lower interest rates, saving you money over the life of the loan. On the other hand, a lower credit score may lead to higher interest rates, making borrowing more expensive.

Loan Approval: Lenders also consider credit scores when deciding whether to approve a loan application. A good credit score increases the chances of loan approval, while a poor credit score may result in rejection or require a cosigner to secure the loan.

Loan Terms: In addition to interest rates and approval, credit scores can influence the terms of a loan. Borrowers with excellent credit may be offered more favorable terms, such as longer repayment periods or higher borrowing limits, compared to those with lower credit scores.

Improving Your Credit Score: If you want to improve your credit score to secure better loan terms, focus on making timely payments, keeping credit card balances low, and avoiding opening multiple new accounts in a short period. These practices can help boost your credit score over time.

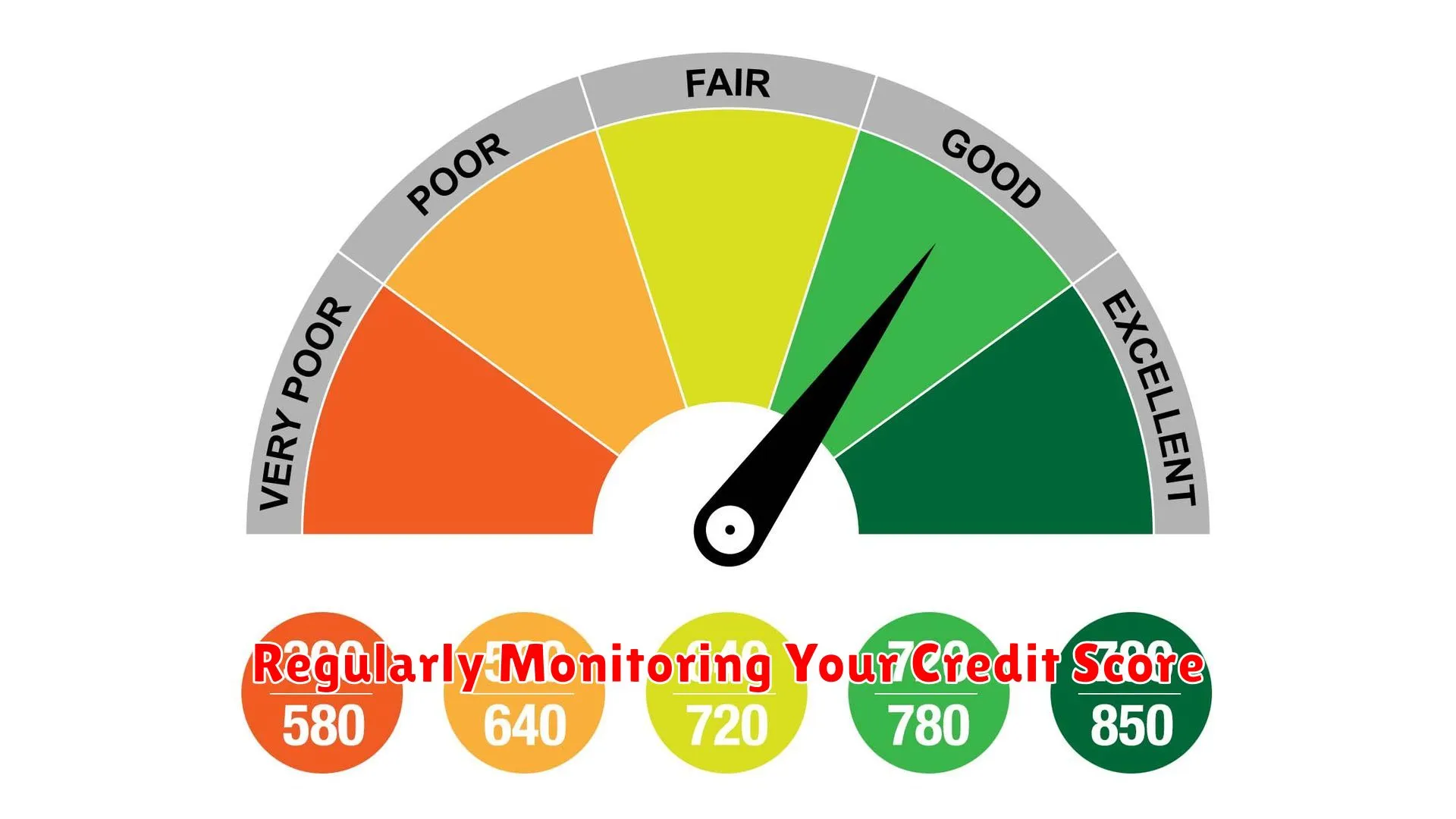

Regularly Monitoring Your Credit Score

Monitoring your credit score regularly is a key aspect of maintaining healthy financial management. Your credit score plays a crucial role in your financial well-being and impacts your ability to access various financial products.

Why Regular Monitoring is Important:

- Identify Errors: Regularly checking your credit report allows you to spot any errors or inaccuracies that could negatively impact your score. Disputing and correcting such inaccuracies is essential for maintaining an accurate credit profile.

- Prevent Fraud: Monitoring your credit score can help you detect any unauthorized activity or signs of identity theft promptly. Early detection can prevent further damage and help you take necessary actions to safeguard your credit.

- Track Progress: By keeping an eye on your credit score regularly, you can track your financial progress over time. Understanding the factors that influence your score enables you to make informed decisions to improve it.

How to Monitor Your Credit Score:

- Utilize Credit Monitoring Services: There are various credit monitoring services available that offer real-time updates on your credit score and report changes. These services can alert you to any suspicious activities.

- Check Your Credit Report Annually: Take advantage of the free credit reports offered by major credit bureaus annually. Reviewing these reports can help you identify any discrepancies and address them promptly.

By regularly monitoring your credit score, you can stay informed about your financial health and take proactive steps to improve it.

Conclusion

Understanding and actively working to improve your credit score is crucial for financial health. By managing your finances responsibly and staying informed about credit, you can take control of your rating and set yourself up for better opportunities in the future.