Learn how to attain financial freedom through effective strategies and disciplined approaches in our guide to achieving independence and security in your financial endeavors.

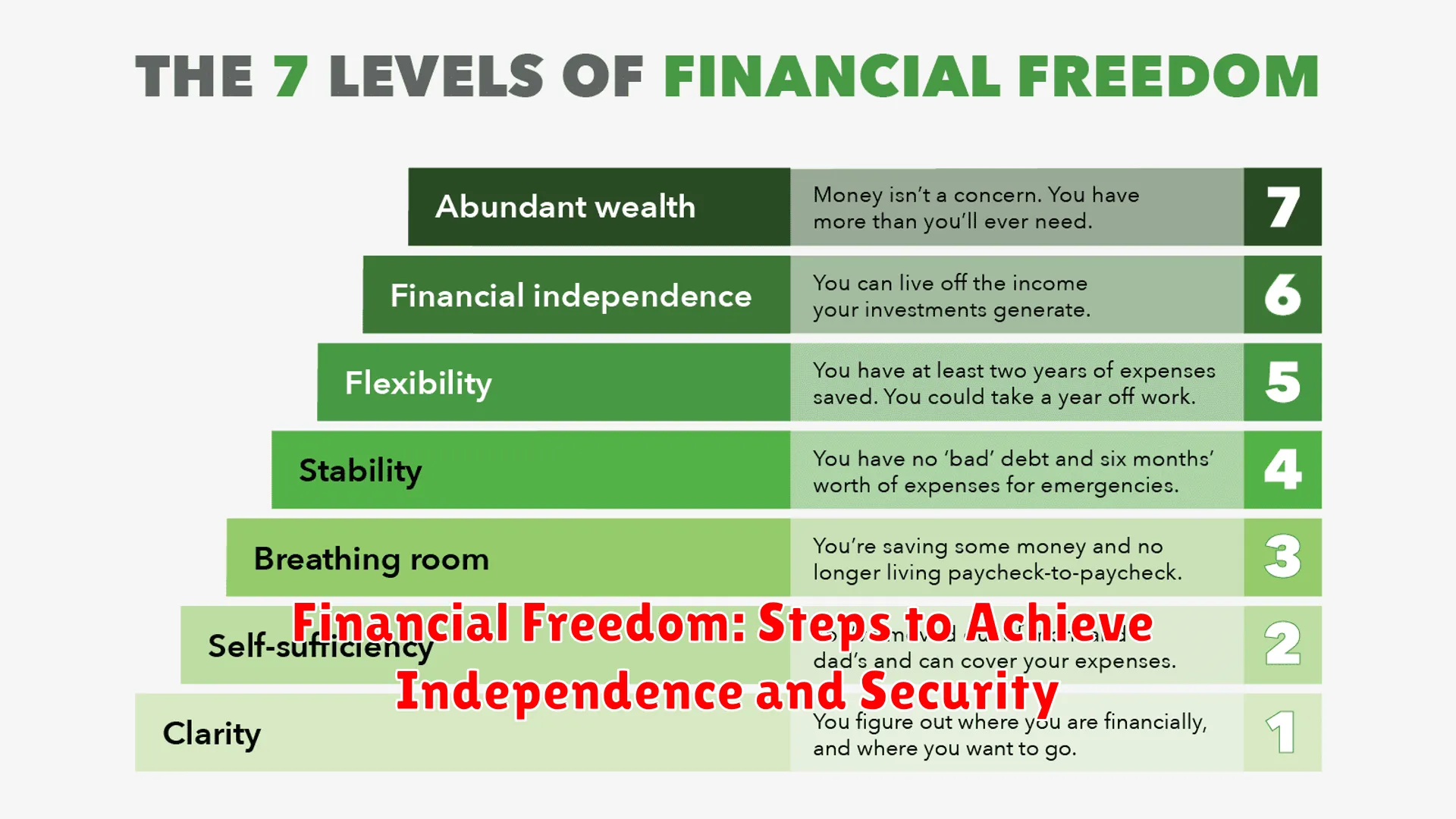

Defining Financial Freedom

Financial freedom is a state where an individual has complete control over their financial decisions and resources, enabling them to live the life they desire without the constraints of money-related stress. It is about having the ability to cover all essential expenses, save for the future, and pursue one’s passions and aspirations without being limited by financial concerns.

At its core, financial freedom is not just about accumulating wealth but also about achieving a sense of security, peace of mind, and independence. It involves having enough financial stability to weather unexpected challenges or setbacks, being able to invest in personal growth and experiences, and ultimately having the freedom to make choices that align with one’s values and goals.

While the concept of financial freedom may vary from person to person based on individual circumstances and priorities, the fundamental aspect remains the same: it is the ability to live life on your own terms without being shackled by financial burdens. It is a journey towards empowerment, self-reliance, and the realization of your true potential through sound financial management and smart decision-making.

Creating a Plan for Financial Independence

Financial independence is a goal that many aspire to achieve, but it requires careful planning and strategic steps. To create a solid plan for financial independence, consider the following key elements:

Evaluate Your Current Financial Situation

Start by assessing your current income, expenses, savings, and debt. Understanding where you stand financially is crucial in determining the steps you need to take towards independence.

Set Clear Goals

Define your financial goals, whether it’s retiring early, owning a home, starting a business, or traveling the world. Setting clear, achievable goals will guide your financial planning process.

Create a Budget

Develop a budget that aligns with your goals. Track your expenses, prioritize essential spending, and identify areas where you can cut back to save more towards your financial independence.

Build an Emergency Fund

Establish an emergency fund to cover unexpected expenses and prevent setbacks in your financial journey. Aim to save at least three to six months’ worth of living expenses.

Invest Wisely

Consider investment options that align with your risk tolerance and financial goals. Diversifying your investment portfolio can help you build wealth and achieve long-term financial independence.

Monitor and Adjust Your Plan

Regularly review your financial plan, track your progress towards your goals, and make adjustments as needed. Stay flexible and adaptable as your financial situation evolves.

By creating a well-thought-out plan for financial independence and taking proactive steps towards your goals, you can pave the way towards a secure and financially free future.

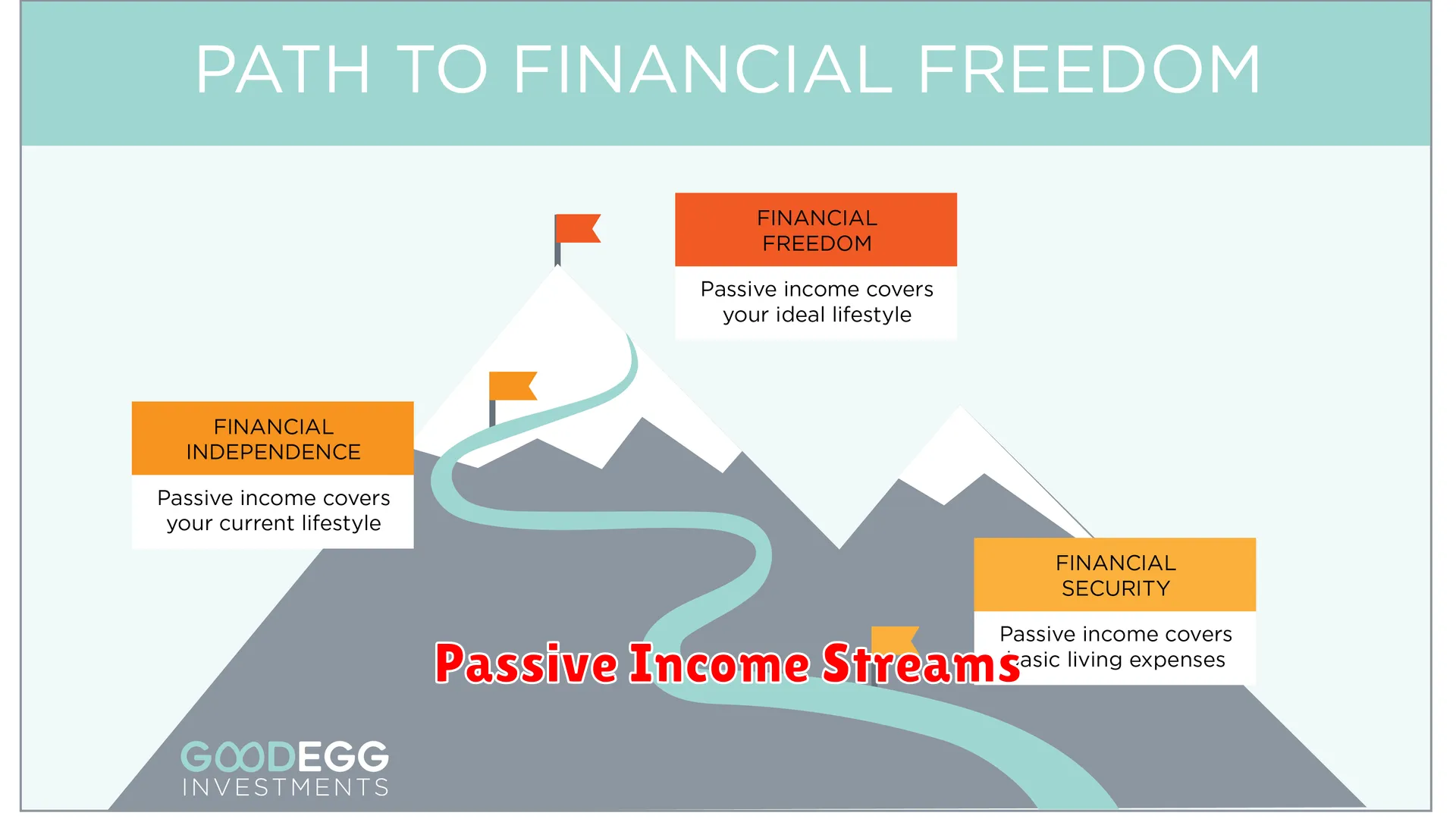

Passive Income Streams

Passive income streams are a key component in achieving financial freedom, providing a reliable source of income that requires minimal effort to maintain. By diversifying your income sources and incorporating passive streams into your financial strategy, you can work towards building wealth and securing your financial future.

Investing in rental properties is a popular method of generating passive income. By purchasing properties and renting them out, you can earn a consistent monthly income without actively managing the day-to-day operations. This can be a lucrative way to build wealth over time.

Another way to create passive income is through dividend-paying stocks. By investing in well-established companies that distribute dividends to shareholders, you can earn a regular income stream without having to actively trade stocks.

Creating digital products, such as e-books, online courses, or software, is also a great way to generate passive income. Once the initial product is created and marketed, you can continue to earn income from sales with minimal ongoing effort.

Achieving a Balanced Lifestyle

In the journey towards financial freedom, it’s essential to also prioritize achieving a balanced lifestyle. Balancing financial goals with personal well-being is key to long-term success and happiness.

Managing Work-Life Balance

One crucial aspect of a balanced lifestyle is managing work-life balance. It’s important to dedicate time not only to work and career advancement but also to personal relationships, hobbies, and self-care. Setting boundaries and prioritizing self-care activities can help prevent burnout and ensure overall well-being.

Financial Wellness

Financial wellness is another vital component of a balanced lifestyle. It involves not only saving and investing wisely but also budgeting effectively and planning for the future. By cultivating good financial habits and making informed decisions, individuals can achieve financial stability and peace of mind.

Health and Fitness

Physical health is interconnected with financial well-being and overall happiness. Incorporating regular exercise, a balanced diet, and sufficient rest into your routine can boost energy levels, reduce stress, and enhance productivity. Prioritizing health and fitness contributes to a holistic approach towards a balanced lifestyle.

Mental Well-Being

Maintaining mental well-being is equally important in the pursuit of financial freedom. Practices such as mindfulness, meditation, or engaging in hobbies that bring joy can help reduce anxiety and improve mental resilience. Building a strong support system and seeking professional help when needed are vital steps in nurturing mental health.

By integrating these elements into your life while striving for financial independence, you can achieve a well-rounded and fulfilling lifestyle that encompasses both financial security and personal well-being.

Maintaining Financial Security

Once you have achieved financial freedom, it is vital to focus on maintaining financial security. This involves establishing a solid foundation that will help safeguard your financial well-being in the long term.

One important step in maintaining financial security is to create an emergency fund. This fund acts as a safety net, providing you with the necessary funds to cover unexpected expenses such as medical emergencies or job loss without derailing your long-term financial goals.

Additionally, regularly reviewing and adjusting your budget is key to ensuring your financial security. By tracking your income and expenses, you can identify areas where you can cut back and redirect funds towards savings and investments, further strengthening your financial position.

Protecting yourself with insurance is another crucial aspect of maintaining financial security. Whether it’s health insurance, life insurance, or disability insurance, having the right coverage in place can help mitigate financial risks and protect your assets.

Furthermore, diversifying your investments is essential to reduce risk and preserve your wealth. By spreading your investments across different asset classes, you can minimize the impact of market fluctuations on your overall financial portfolio.

Conclusion

By following disciplined saving, investing wisely, and prioritizing financial education, attaining financial freedom is achievable.