Are you looking to secure your financial future? Learn the basics of investing in stocks, bonds, and mutual funds in our comprehensive guide, “Investing for the Future.” Discover how these investment vehicles can help you achieve your long-term financial goals.

Types of Investment Vehicles

When looking to invest for the future, there are several types of investment vehicles that individuals can consider. These investment vehicles are diverse in nature and cater to different risk appetites and investment goals.

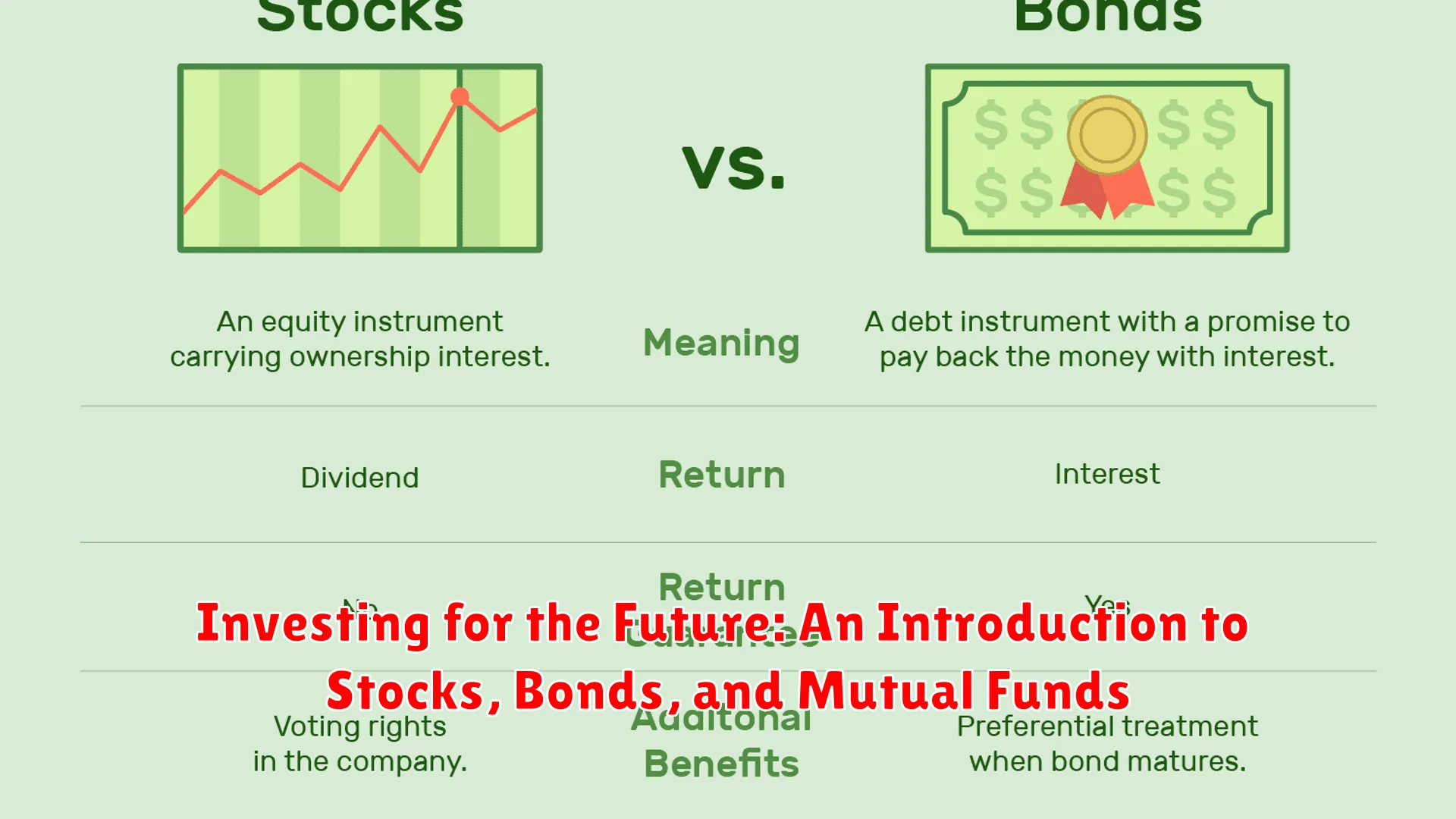

1. Stocks

Stocks represent ownership in a company. When you buy a stock, you essentially own a portion of that company. Stocks can offer significant returns but also come with higher volatility and risks. Investors in stocks aim to benefit from capital appreciation and dividends.

2. Bonds

Bonds are debt securities issued by governments or corporations. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are typically considered less risky than stocks and are often used to provide stability and income in a portfolio.

3. Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds offer diversification and are suitable for investors who prefer a hands-off approach to investing.

These are just a few examples of the various investment vehicles available to investors. Each type of investment vehicle comes with its own set of risks and potential rewards, so it is essential to understand your financial goals, risk tolerance, and investment time horizon before making any investment decisions.

Understanding Stock Markets

Stock markets are essential components of the financial world where investors buy and sell shares of publicly traded companies. Understanding stock markets is crucial for anyone looking to invest in stocks, bonds, or mutual funds.

Key points to understand about stock markets:

- Market Basics: Stock markets provide a platform for companies to raise capital by offering shares to the public. Investors can then buy these shares, becoming partial owners of the company.

- Investor Participation: Individual investors, institutional investors, and traders are active participants in stock markets. Each group plays a unique role in the market’s dynamics.

- Market Volatility: Stock markets are subject to fluctuations influenced by various factors such as economic indicators, company performance, geopolitical events, and investor sentiment.

- Risk and Reward: Investing in stocks can offer potentially high returns but comes with risks. Understanding risk tolerance and diversification is crucial for managing investment portfolios.

- Market Analysis: Investors rely on fundamental and technical analysis to assess stock performance and make informed investment decisions.

By comprehending how stock markets operate and the factors driving their movements, investors can make informed decisions to build a robust investment portfolio for the future.

The Role of Bonds in Your Portfolio

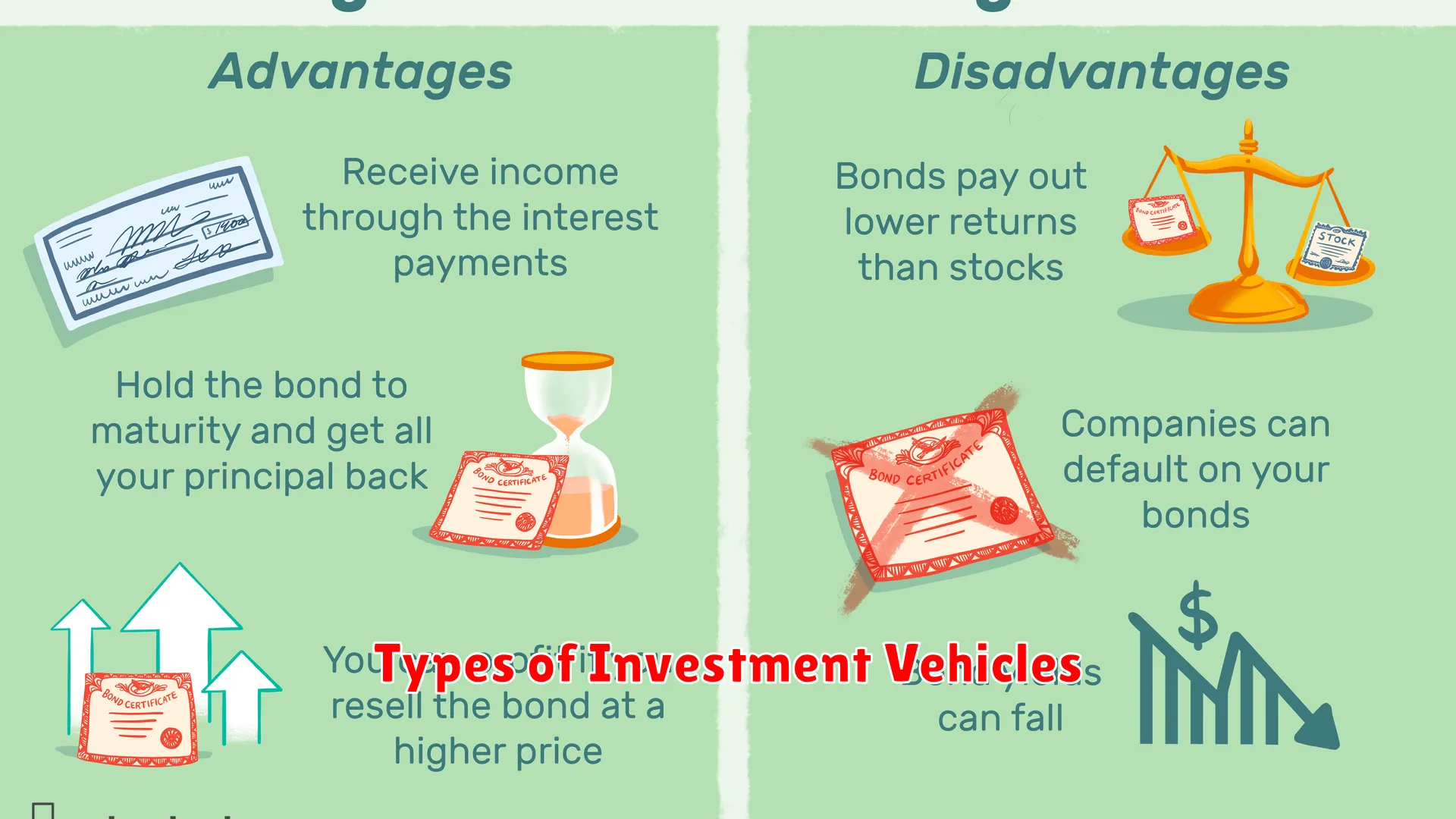

When it comes to building a well-rounded investment portfolio, bonds play a crucial role alongside stocks and mutual funds. Bonds are essentially debt securities issued by governments, municipalities, or corporations to raise capital. As an investor, adding bonds to your portfolio can provide stability, income, and diversification.

Stability and Income

One of the key benefits of including bonds in your portfolio is the stability they offer. Unlike stocks, which can be volatile, bonds are generally considered to be less risky. They provide a predictable stream of income through interest payments, making them attractive to more conservative investors looking for steady returns.

Diversification

Bonds also play a crucial role in diversifying your investment holdings. By holding a mix of stocks, bonds, and mutual funds, you can reduce overall portfolio risk. During times of market volatility, bonds often perform well, providing a buffer against stock market fluctuations.

Interest Rate Sensitivity

It’s important to note that bonds are sensitive to changes in interest rates. When interest rates rise, bond prices tend to fall, and vice versa. Understanding this relationship is key to managing the risks associated with bonds in your portfolio.

Exploring Mutual Funds

When it comes to investing for the future, one popular option that many people consider is mutual funds. Mutual funds are investment vehicles that pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the fund’s investors.

One of the key benefits of mutual funds is diversification. By investing in a mutual fund, you spread your investment across a range of securities, which can help reduce risk compared to investing in individual stocks or bonds. This diversification can help cushion the impact of any losses in a particular security.

Another advantage of mutual funds is accessibility. They offer an easy way for individual investors to access a diversified portfolio without the need to directly manage their investments. This makes mutual funds a convenient option for those who may not have the time or expertise to build and manage their investment portfolios.

Furthermore, mutual funds come in different types, such as actively managed funds and passively managed funds (index funds). Actively managed funds seek to outperform the market by selecting specific investments, while index funds aim to mirror the performance of a specific market index. Investors can choose the type of fund that aligns with their investment goals and preferences.

Before investing in mutual funds, it is essential to understand the fund’s investment objectives, fees, and past performance. Conducting thorough research and seeking advice from financial professionals can help investors make informed decisions about which mutual funds are suitable for their financial goals.

Diversifying Your Investments

When it comes to investing for the future, diversifying your investments is a crucial strategy to consider. Diversification involves spreading your investment funds across different asset classes to reduce risk and optimize potential returns.

As mentioned in the article “Investing for the Future: An Introduction to Stocks, Bonds, and Mutual Funds,” diversification can help safeguard your portfolio against volatility in any single asset type. By allocating your funds into a mix of stocks, bonds, and mutual funds, you can minimize the impact of market fluctuations on your overall investment performance.

Stocks offer the potential for high returns but also come with greater risk. By combining them with bonds, which are generally considered safer investments with fixed interest payments, and mutual funds that pool funds from multiple investors to invest in a diversified portfolio, you create a balanced investment strategy.

Additionally, diversifying your investments beyond these traditional asset classes by considering alternative investments such as real estate, commodities, or exchange-traded funds (ETFs) can further enhance your portfolio’s diversification and potentially increase your long-term growth potential.

Conclusion

Investing in stocks, bonds, and mutual funds offers diverse opportunities for long-term financial growth and stability. Understanding the risks, diversifying your portfolio, and seeking professional advice are crucial for successful investment strategies.