Discover the financial magic of compound interest and learn how it can boost your wealth steadily over time. Uncover the secrets to maximizing your investments and securing a prosperous future through the power of compounding.

Understanding Compound Interest

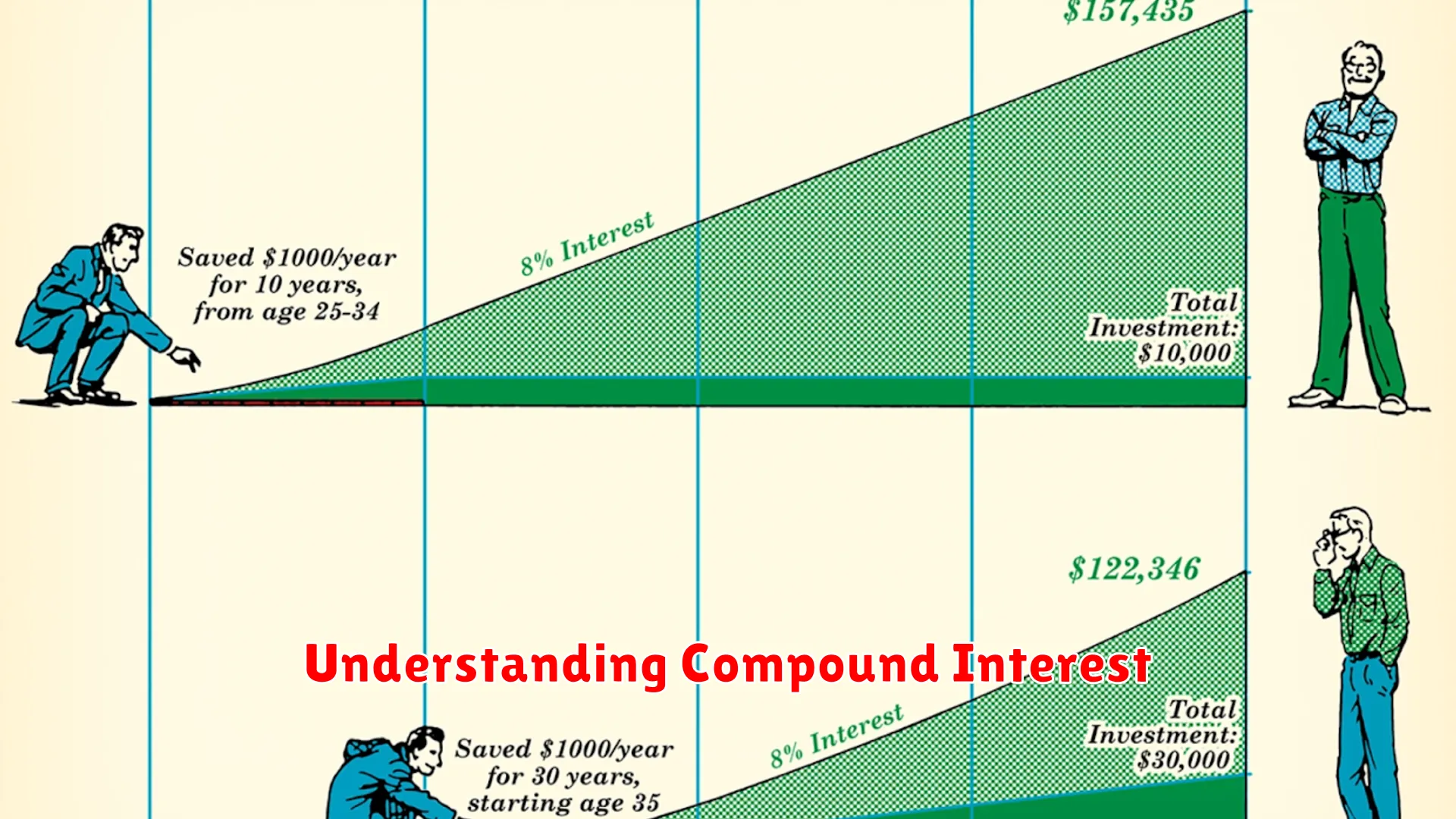

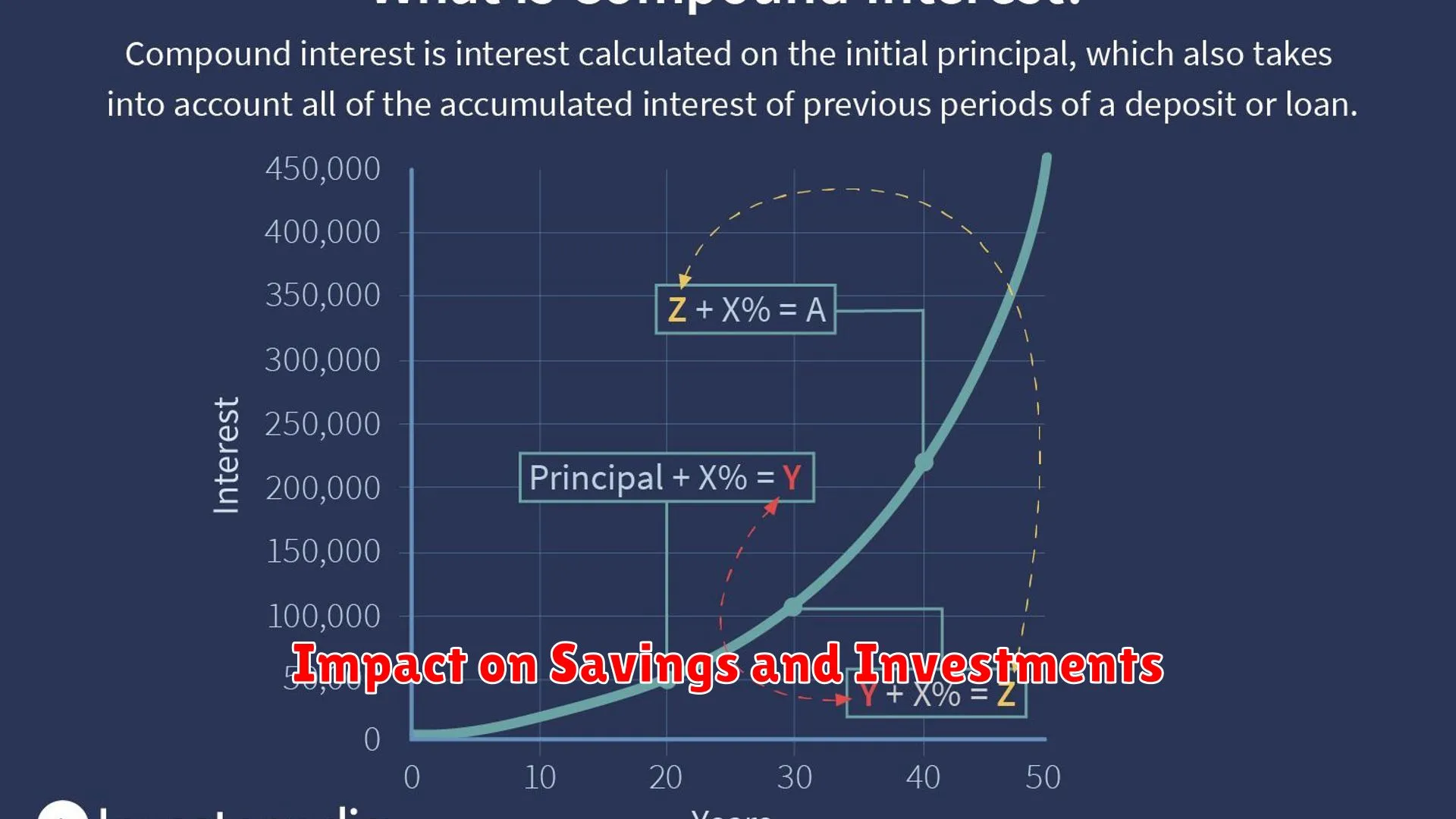

Compound interest is a powerful financial concept that can significantly impact your wealth over time. It is the interest calculated on the initial principal amount, which also includes all the interest that has been added previously. In simple terms, compound interest means you earn interest on both your original investment and the interest it has already generated.

To understand how compound interest works, consider this: when you invest money in an account that offers compound interest, your earnings can grow exponentially over time. The key to maximizing the benefits of compound interest is time. The longer your money stays invested, the more it can grow.

One of the essential aspects of compound interest is compounding periods. The more frequent the compounding periods, the faster your investment can grow. For instance, if interest is compounded quarterly rather than annually, your investment will grow at a quicker rate.

By being patient and allowing your investments to grow through compound interest, you can witness the power of compounding. Even small contributions made regularly can lead to significant wealth accumulation over time. Understanding and harnessing the potential of compound interest can be a game-changer in building your financial future.

The Rule of 72

When it comes to understanding the potential growth of your wealth over time, the Rule of 72 is a valuable tool to have in your financial toolkit. This rule is a simple yet powerful concept that can help you estimate how long it will take for your investments to double based on a fixed annual rate of return.

The Rule of 72 is calculated by dividing 72 by the annual interest rate or growth rate of your investment. The result gives you an approximate number of years it will take for your investment to double in value. For example, if you have an investment with an annual return of 8%, using the Rule of 72 would estimate that it would take approximately 9 years for your investment to double (72 divided by 8 equals 9).

Understanding the Rule of 72 can provide you with valuable insights into the power of compound interest and the impact of different interest rates on your wealth accumulation. By utilizing this rule, you can make more informed decisions about where to allocate your funds and how to make the most of your investment opportunities over time.

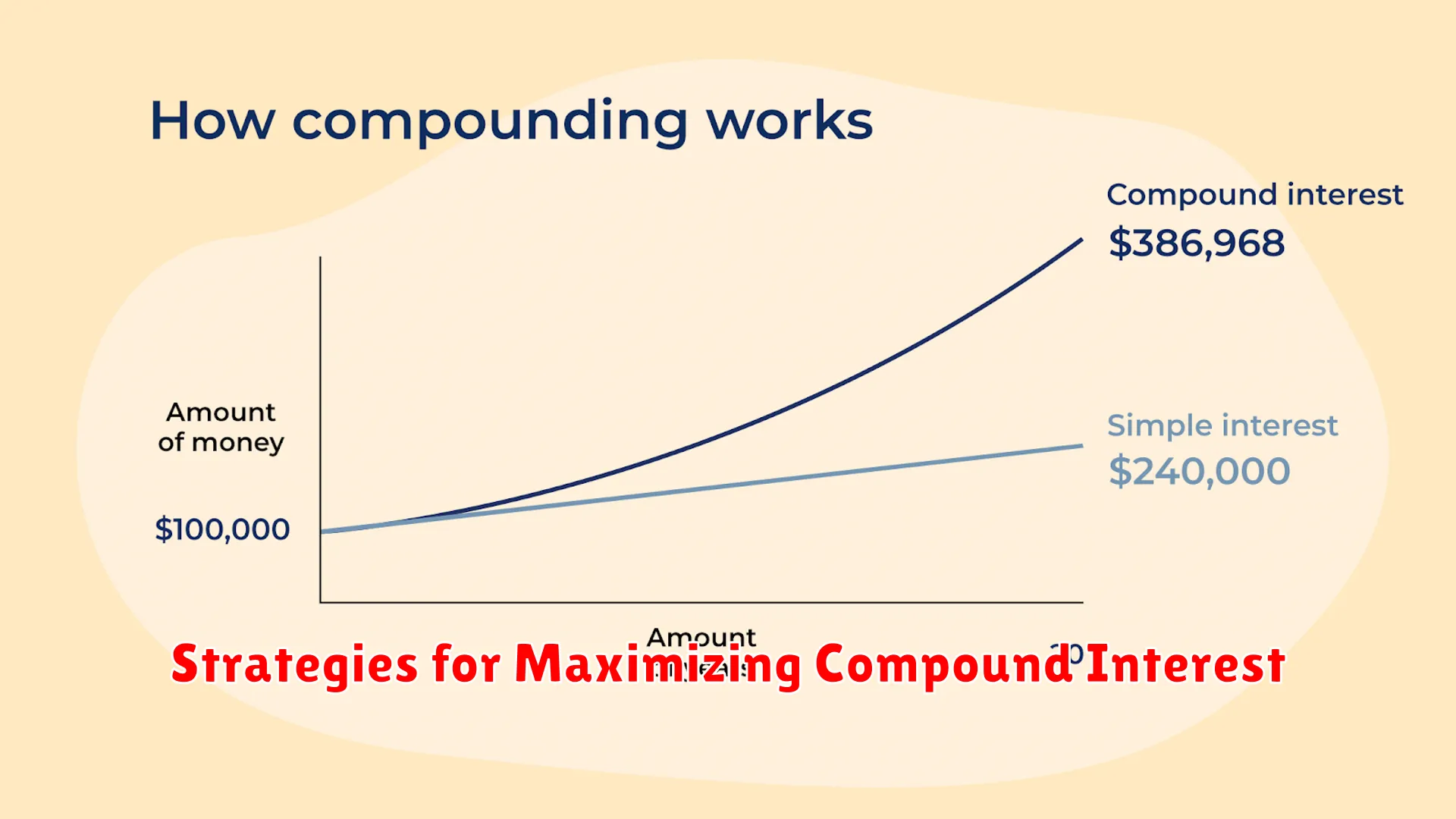

Strategies for Maximizing Compound Interest

Compound interest is a powerful tool for building wealth over time. By understanding and implementing strategies to maximize its benefits, you can accelerate your financial growth significantly.

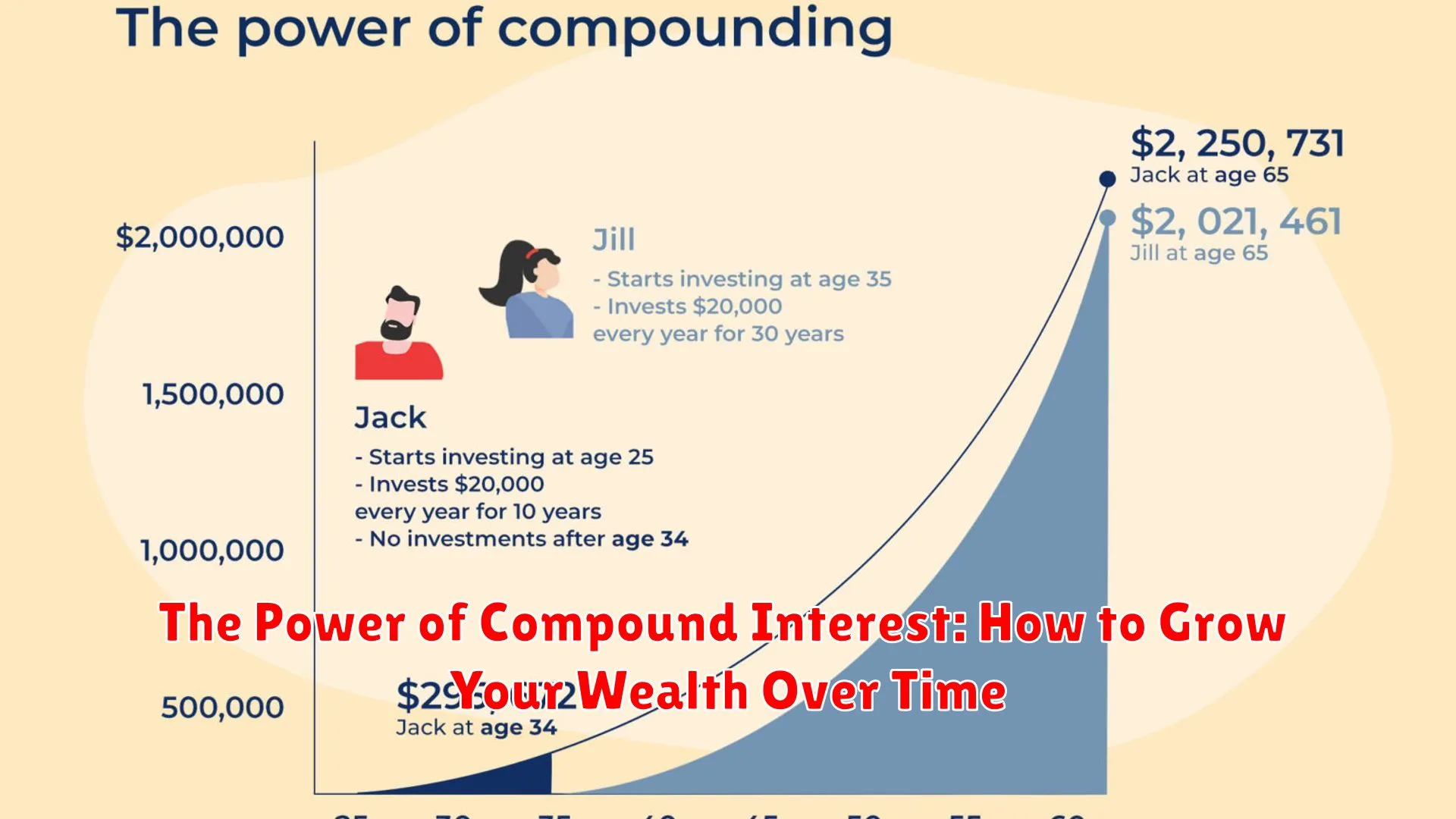

1. Start Early

One of the most effective ways to make the most of compound interest is to start investing early. The longer your money has to grow, the greater the compounding effect will be. Even small contributions made early on can result in substantial growth over time.

2. Consistent Contributions

Consistency is key when it comes to maximizing compound interest. Make regular contributions to your investment accounts to ensure a steady flow of earnings that can compound over time. Setting up automatic deposits can help you stay on track.

3. Reinvest Your Earnings

Instead of cashing out your investment gains, consider reinvesting them back into your portfolio. Reinvesting dividends and interest allows you to take advantage of the power of compounding, as your earnings generate even more earnings over time.

4. Choose Investments Wisely

When selecting investments, opt for assets with growth potential and compounding benefits. Diversifying your portfolio can also help manage risk while maximizing the overall returns achieved through compound interest.

5. Stay Invested for the Long Term

While market fluctuations may be inevitable, it’s essential to remain invested for the long term to fully benefit from compound interest. Avoid the temptation to constantly buy and sell investments, as staying the course can lead to greater wealth accumulation over time.

By incorporating these strategies into your financial planning, you can harness the power of compound interest to grow your wealth steadily and secure a more prosperous future.

Impact on Savings and Investments

When it comes to growing your wealth over time, one of the key factors that play a significant role is the impact on savings and investments. The concept of compound interest can greatly influence how your savings and investments grow exponentially.

By consistently saving a portion of your income and investing it wisely, you can take advantage of the power of compound interest. Over time, the interest you earn on your investments is reinvested, leading to accelerated growth in your wealth.

Moreover, the impact of savings and investments fueled by compound interest is evident in the long-term outcomes. Even small amounts saved and invested regularly can snowball into substantial wealth due to the compounding effect.

Understanding the impact of savings and investments through compound interest is crucial for individuals looking to secure their financial future and achieve their long-term goals. By starting early, being consistent, and making informed investment decisions, anyone can harness the power of compound interest to grow their wealth over time.

Compound Interest in Retirement Planning

Compound interest is a powerful financial concept that can significantly impact your retirement planning. It works by accumulating interest on both the initial principal and the interest that has been added to your account over time. This means that as your savings grow, the interest you earn also increases, leading to exponential growth.

When it comes to retirement planning, utilizing compound interest can make a substantial difference in the final amount you have saved. By starting to save early and consistently, you allow time for your money to grow exponentially. Even small contributions can grow into significant sums over time, thanks to the power of compounding.

One key aspect of using compound interest in retirement planning is being patient. It requires a long-term perspective and discipline to let your investments grow and compound over the years. The earlier you start saving, the longer your money has to benefit from compounding.

Additionally, reinvesting your earnings is crucial in maximizing the benefits of compound interest. By allowing your returns to compound instead of withdrawing them, you accelerate the growth of your savings. This strategy can lead to a substantial nest egg for your retirement years.

Overall, understanding and harnessing the power of compound interest is essential for successful retirement planning. By starting early, staying patient, and reinvesting your earnings, you can set yourself up for a financially secure future.

Conclusion

Understanding and harnessing the power of compound interest is key to building substantial wealth over time. By starting early and staying consistent, individuals can benefit greatly from the exponential growth that compound interest offers.